The market in the United Kingdom has been flat over the last week but is up 11% over the past year, with earnings forecast to grow by 14% annually. In this context, identifying high growth tech stocks that can capitalize on these favorable conditions is crucial for investors seeking robust returns.

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

| Filtronic | 21.64% | 33.46% | ★★★★★★ |

| YouGov | 14.43% | 29.79% | ★★★★★☆ |

| STV Group | 13.43% | 47.09% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| Trustpilot Group | 16.23% | 31.98% | ★★★★★☆ |

| IQGeo Group | 11.49% | 63.61% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our UK High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GB Group plc, along with its subsidiaries, offers identity data intelligence products and services across the United Kingdom, the United States, Australia, and internationally, with a market cap of £854.10 million.

Operations: GB Group plc generates revenue from three primary segments: Fraud (£40.20 million), Identity (£156.06 million), and Location (£81.07 million). The company’s services span multiple regions, including the UK, US, Australia, and other international markets.

GB Group’s revenue is projected to grow at 6.8% annually, outpacing the UK market’s 3.7%. Despite a net loss of £48.58 million in FY24, down from £119.79 million the previous year, its earnings are forecasted to surge by 92.89% per year over the next three years, indicating a path towards profitability. The company has also increased its R&D expenses significantly, allocating £20 million this year compared to £15 million last year, highlighting its commitment to innovation and future growth potential.

Simply Wall St Growth Rating: ★★★★☆☆

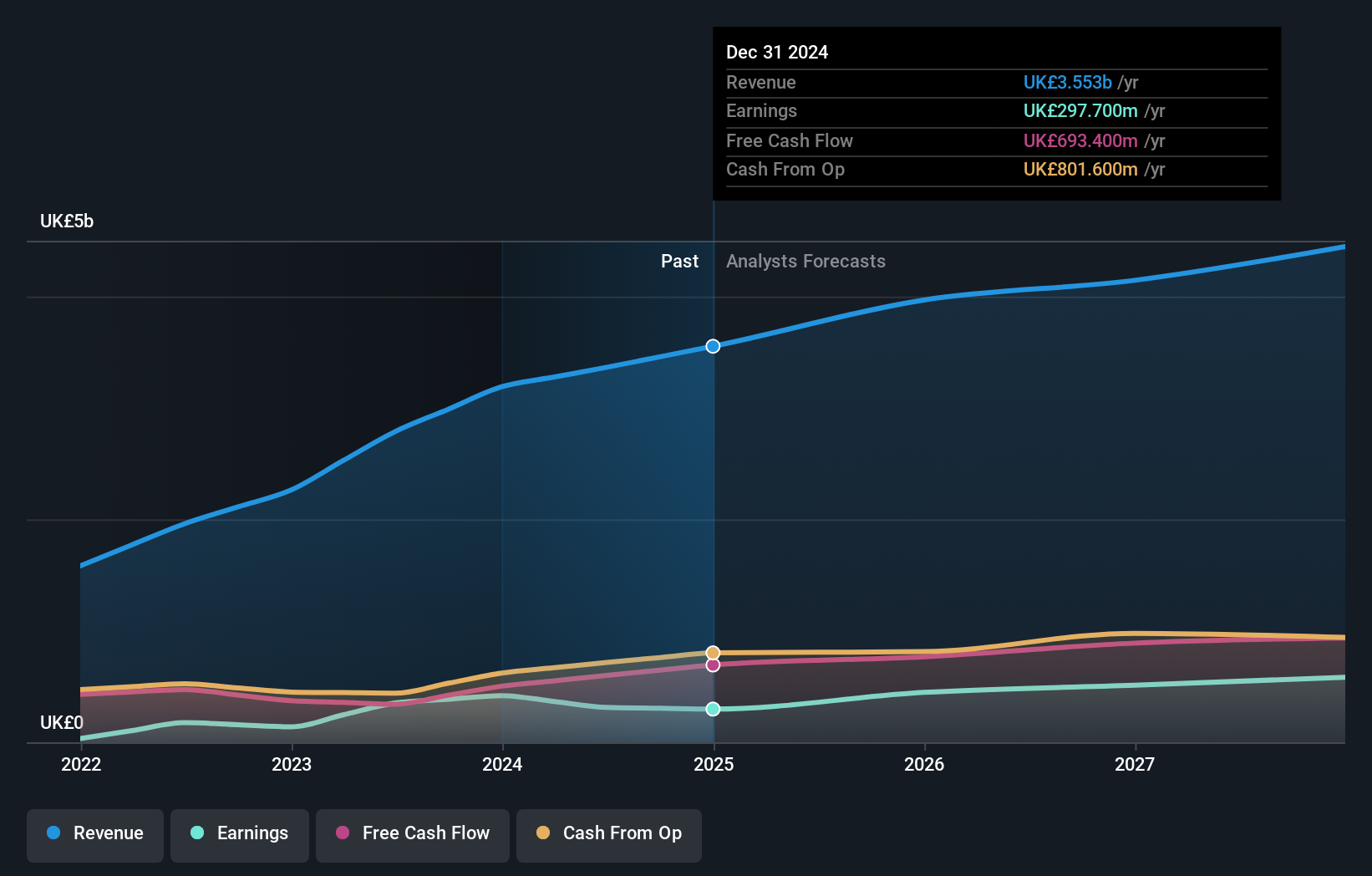

Overview: Informa plc operates as an international events, digital services, and academic research company in various regions including the United Kingdom, Continental Europe, the United States, and China, with a market cap of £11.02 billion.

Operations: Informa generates revenue through four primary segments: Informa Tech (£426.70 million), Informa Connect (£630.20 million), Informa Markets (£1.67 billion), and Taylor & Francis (£636.70 million). The company’s diverse operations span events, digital services, and academic research across multiple global regions.

Informa’s earnings are forecast to grow at 21.5% annually, significantly outpacing the UK market’s 14.3%. Despite a one-off loss of £213.5 million impacting its recent financial results, the company has demonstrated resilience with revenue expected to rise by 6.7% per year, faster than the UK’s average of 3.7%. The company’s R&D expenses have seen a notable increase to £20 million this year from £15 million last year, underscoring its commitment to innovation and future growth potential. Additionally, Informa repurchased 41.67 million shares in H1 2024 for £338.9 million as part of an ongoing buyback program aimed at enhancing shareholder value.

Simply Wall St Growth Rating: ★★★★★☆

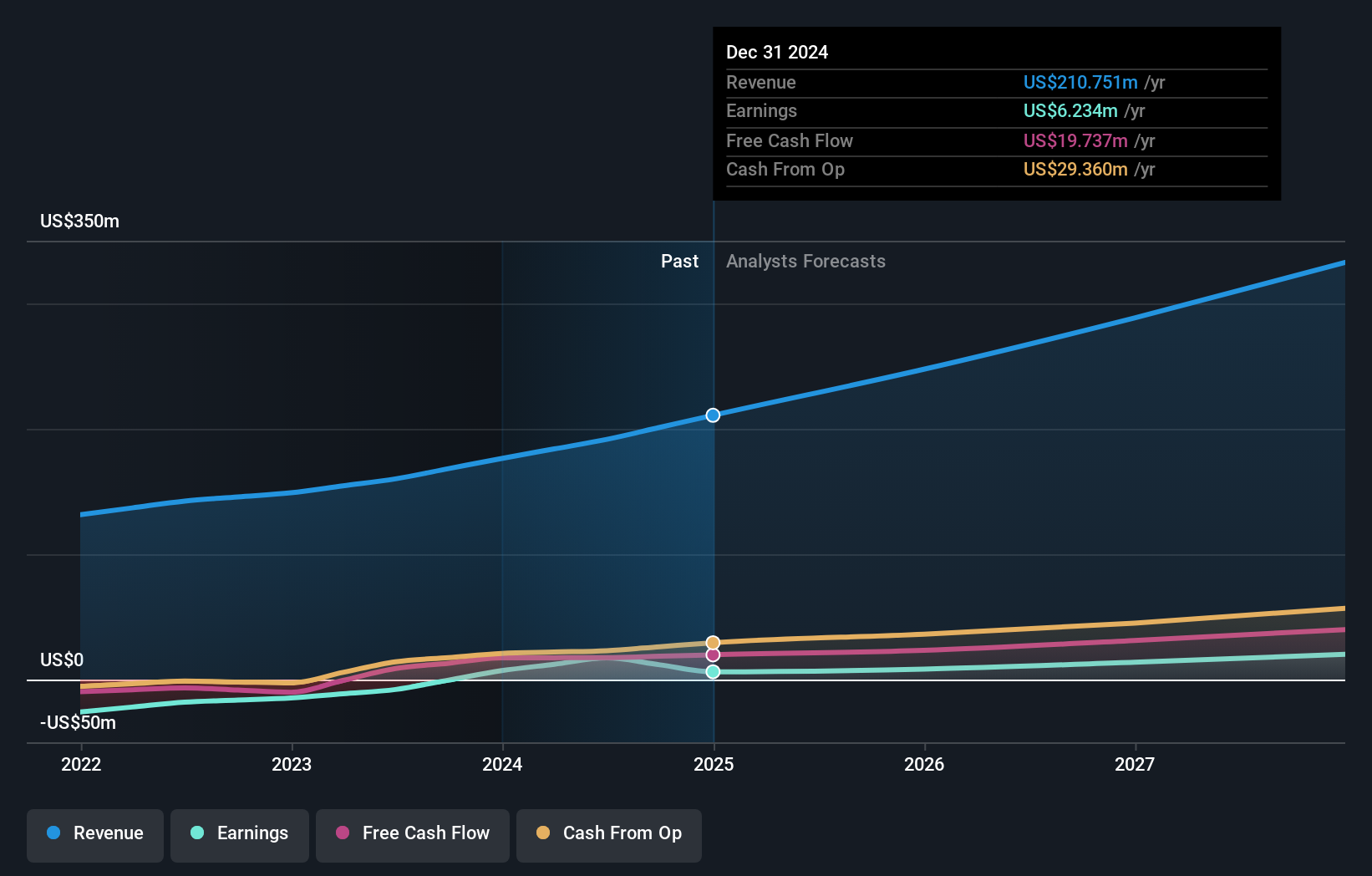

Overview: Trustpilot Group plc develops and hosts an online review platform for businesses and consumers across the United Kingdom, North America, Europe, and internationally, with a market cap of £875.25 million.

Operations: Trustpilot Group plc generates revenue primarily through its Internet Information Providers segment, amounting to $176.36 million. The company focuses on developing and hosting an online review platform that serves businesses and consumers globally.

Trustpilot Group’s revenue is expected to grow at 16.2% annually, significantly outpacing the UK’s market average of 3.7%. With earnings projected to rise by an impressive 32% per year, Trustpilot stands out in the tech sector for its robust growth prospects. The company has also increased its R&D expenses from £10 million last year to £12 million this year, reflecting a commitment to innovation and future expansion. Recent M&A activity involving Trafalgar Acquisition S.à.r.l.’s intention to sell shares adds a layer of complexity but highlights institutional interest in Trustpilot’s potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com