As global markets experience mixed results ahead of the Labor Day holiday, with the Nasdaq Composite facing particular challenges, investors are keenly observing economic indicators and inflation data that suggest a resilient U.S. consumer base. In this dynamic environment, identifying high-growth tech stocks becomes crucial for those looking to capitalize on innovation and market potential amidst fluctuating indices and economic sentiment.

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| TG Therapeutics | 28.62% | 43.05% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 22.41% | 27.42% | ★★★★★★ |

| Sarepta Therapeutics | 24.22% | 44.94% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Scandion Oncology | 41.84% | 75.34% | ★★★★★★ |

| G1 Therapeutics | 27.57% | 57.75% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Adveritas | 50.14% | 144.21% | ★★★★★★ |

| Adocia | 59.08% | 63.00% | ★★★★★★ |

| UTI | 114.97% | 134.61% | ★★★★★★ |

Click here to see the full list of 1274 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Simply Wall St Growth Rating: ★★★★★☆

Overview: FPT Corporation provides IT and telecommunication products and services in Vietnam and internationally, with a market cap of ₫196.87 trillion.

Operations: FPT Corporation generates revenue primarily from its Information Technology and Telecommunication segments, including Global IT Services (₫27.63 billion), Telecommunication (₫15.73 billion), and Software Solutions, System Integration, and Informatics Services (₫7.70 billion). The company also has smaller revenue streams from Digital Content (₫0.64 billion) and Investment, Education, and Others (₫7.27 billion).

FPT Corporation’s recent earnings report highlights a robust performance, with second-quarter revenue reaching VND 15.25 trillion, up from VND 12.48 trillion the previous year, and net income rising to VND 1.87 trillion from VND 1.51 trillion. The company’s annual profit growth is forecasted at an impressive 25.9%, outpacing the VN market’s expected growth of 20%. With R&D expenses contributing significantly to innovation, FPT’s strategic expansion into Malaysia aims to bolster its presence in key sectors like Energy and Healthcare while addressing increasing demand for AI solutions.

Simply Wall St Growth Rating: ★★★★★☆

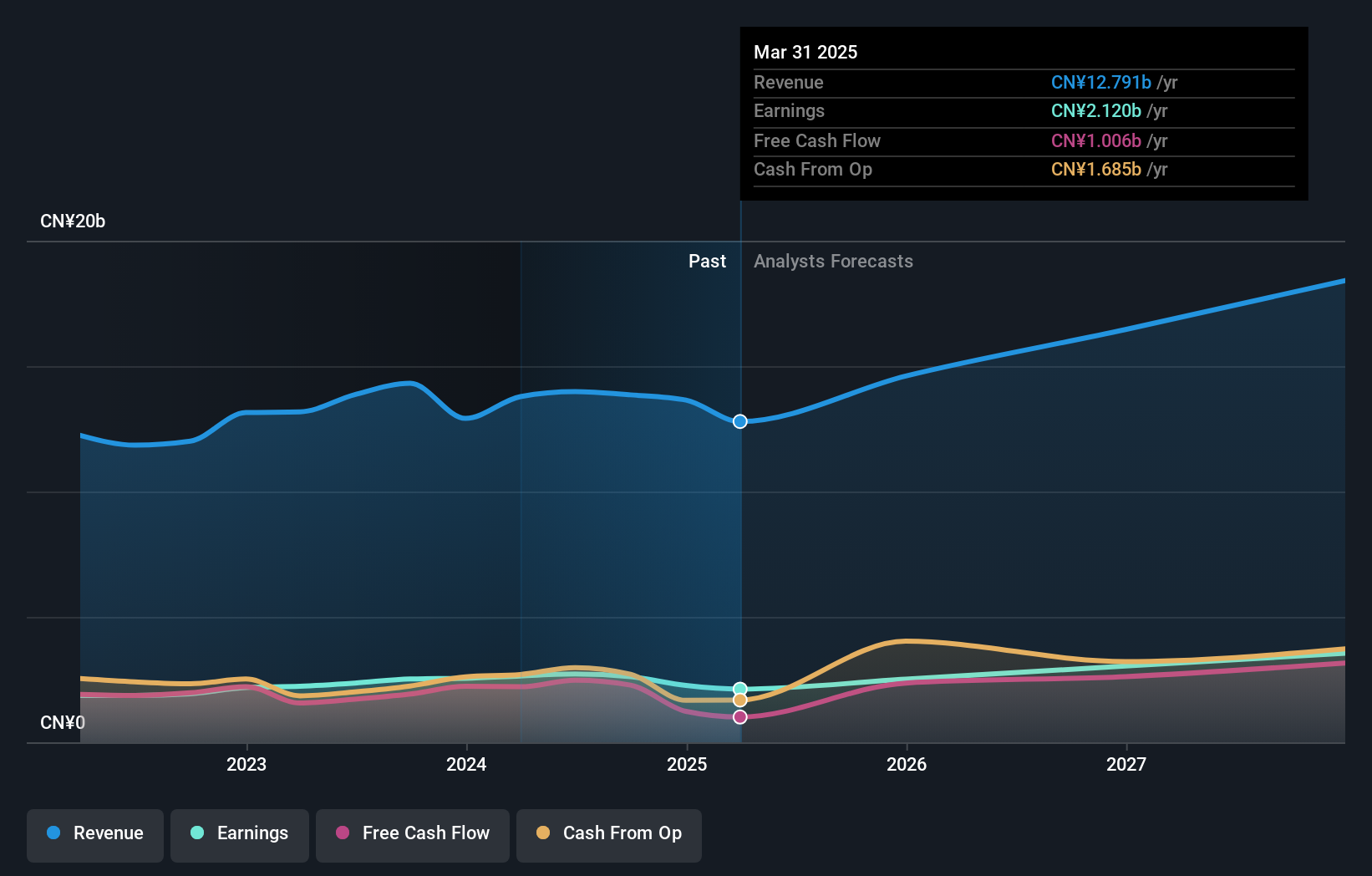

Overview: Shanghai Baosight Software Co., Ltd. offers industrial solutions in China and has a market cap of CN¥70.97 billion.

Operations: Baosight Software specializes in providing industrial solutions within China. The company generates revenue primarily through its software and system integration services, focusing on sectors such as manufacturing and logistics.

Shanghai Baosight Software Ltd. reported a strong half-year performance with sales reaching ¥6.73 billion, up from ¥5.67 billion last year, and net income increasing to ¥1.33 billion from ¥1.16 billion. The company’s revenue is projected to grow at 20.3% annually, outpacing the market’s 13.7%, while earnings are expected to rise by 23.2% per year over the next three years, highlighting robust future prospects in an evolving tech landscape driven by AI and software innovations.

Simply Wall St Growth Rating: ★★★★★☆

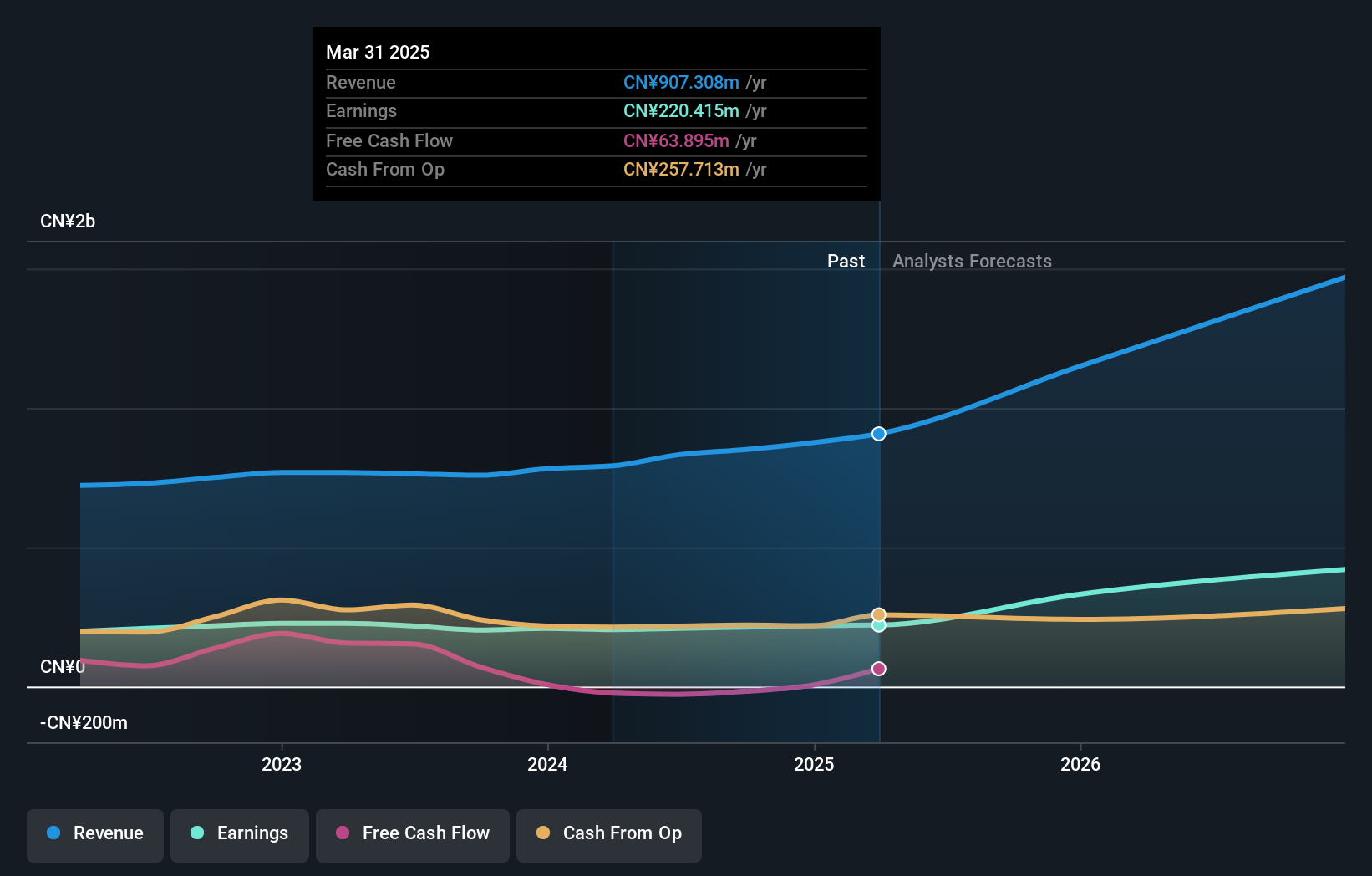

Overview: CASTECH Inc. focuses on the research and development, production, and sale of crystal components, precision optical components, and laser devices primarily in China with a market cap of CN¥10.54 billion.

Operations: CASTECH Inc. generates revenue from the production and sale of crystal components, precision optical components, and laser devices. The company primarily operates in China with a market cap of CN¥10.54 billion.

CASTECH reported half-year sales of ¥439.5 million, a 13.1% increase from the previous year, with net income slightly dipping to ¥109.57 million from ¥110.26 million. Earnings are projected to grow at 28% annually over the next three years, outpacing the market’s 23.2%. The company’s revenue is expected to rise by 23.7% per year, driven by robust investments in R&D—accounting for a significant portion of expenses—to innovate within AI and software segments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com