The most oversold stocks in the information technology sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

FormFactor Inc FORM

- On July 31, FormFactor posted better-than-expected quarterly earnings. “FormFactor set an all-time record for DRAM probe-card revenue in the second quarter, driven by sequential doubling of high-bandwidth-memory revenue and steady DDR5 new-design activity,” said Mike Slessor, CEO of FormFactor, Inc. The company’s stock fell around 21% over the past five days and has a 52-week low of $29.71.

- RSI Value: 27.73

- FORM Price Action: Shares of FormFactor gained 1.1% to trade at $41.36 on Monday.

- Benzinga Pro’s real-time newsfeed alerted to latest FORM news.

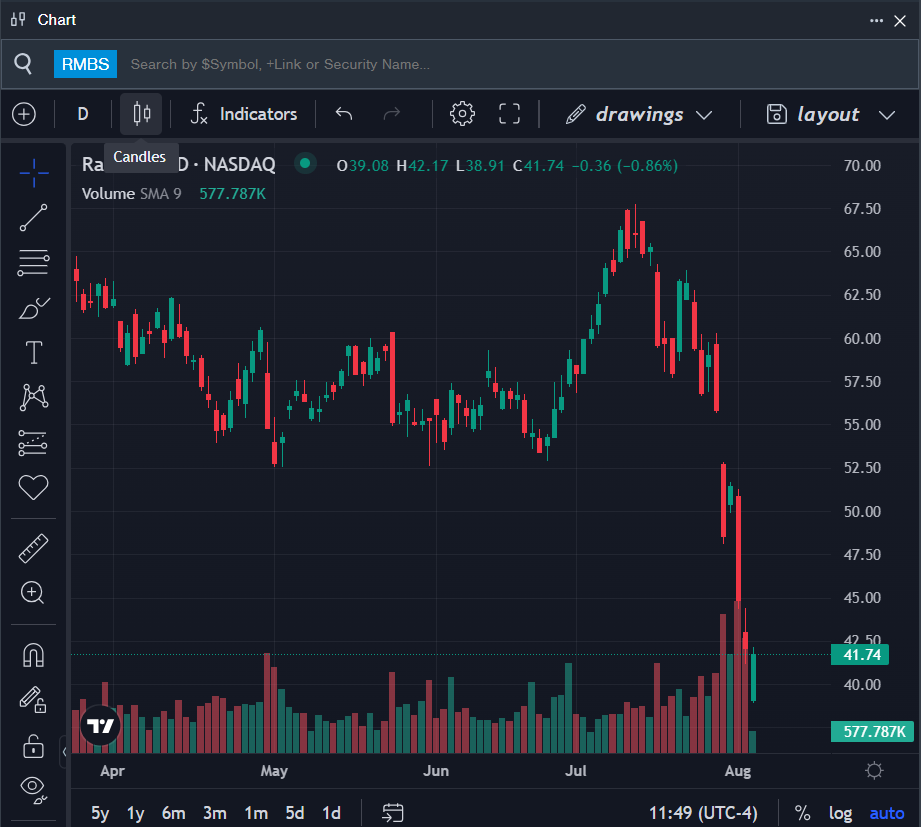

Rambus Inc RMBS

- On July 29, Rambus reported mixed second-quarter financial results. “We delivered solid second quarter results with robust growth in product revenue and excellent cash from operations,” said Luc Seraphin, chief executive officer of Rambus. The company’s stock fell around 21% over the past five days. It has a 52-week low of $38.91.

- RSI Value: 28.71

- RMBS Price Action: Shares of Rambus fell 0.6% to trade at $41.84 on Monday.

- Benzinga Pro’s charting tool helped identify the trend in RMBS stock.

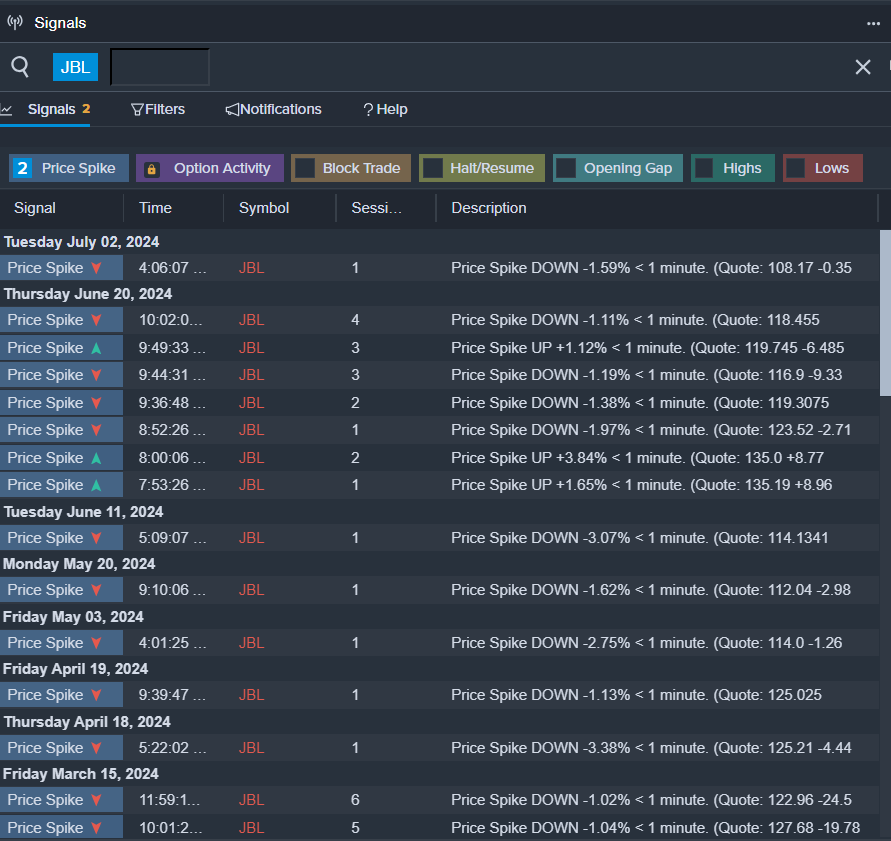

Jabil Inc JBL

- On July 18, Jabil declared a quarterly dividend of 8 cents per share of common stock to shareholders of record as of Aug. 15. The company’s shares fell around 10% over the past five days and has a 52-week low of $95.84.

- RSI Value: 29.02

- JBL Price Action: Shares of Jabil fell 1.2% to trade at $98.43 on Monday.

- Benzinga Pro’s signals feature notified of a potential breakout in JBL shares.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.