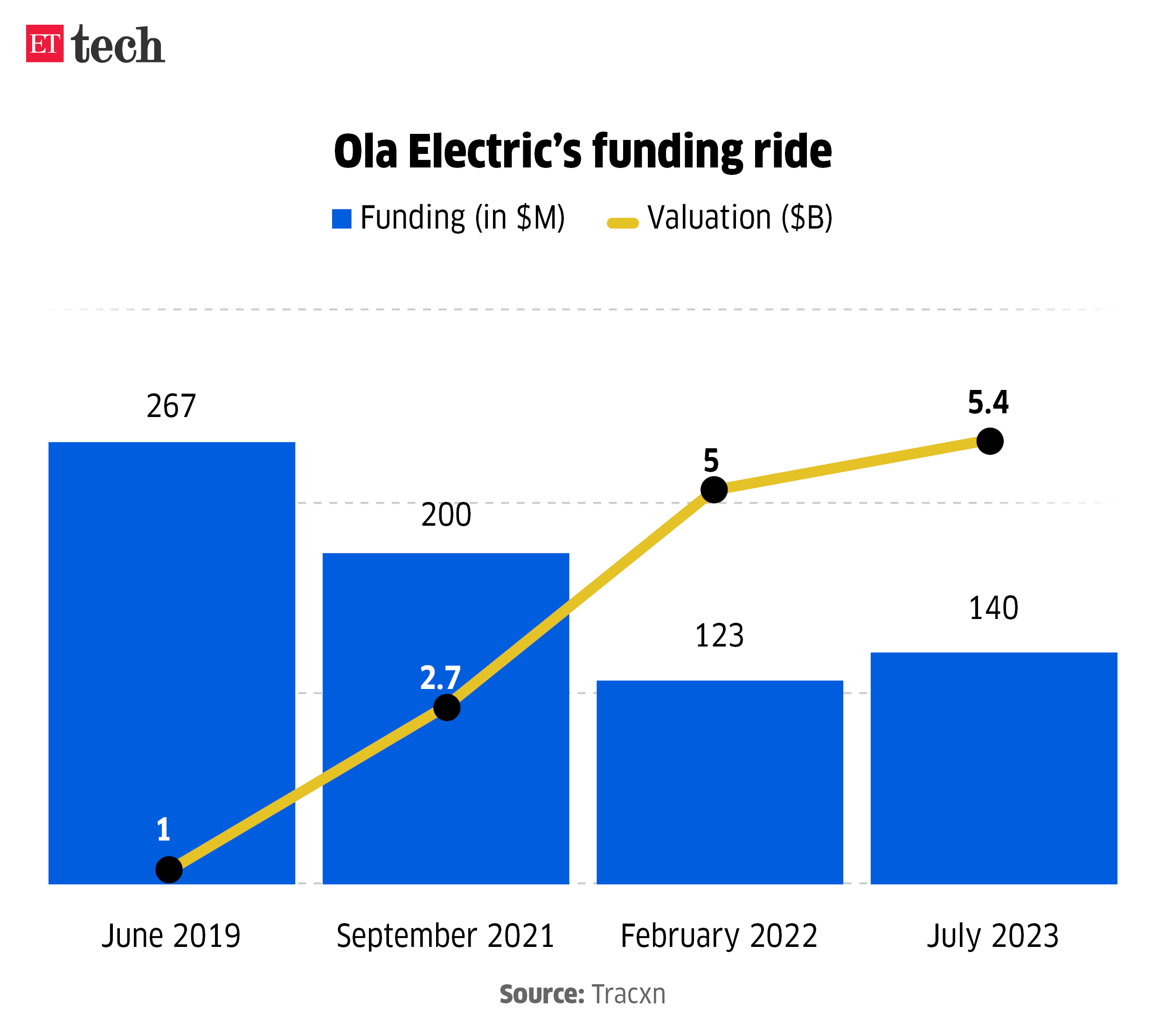

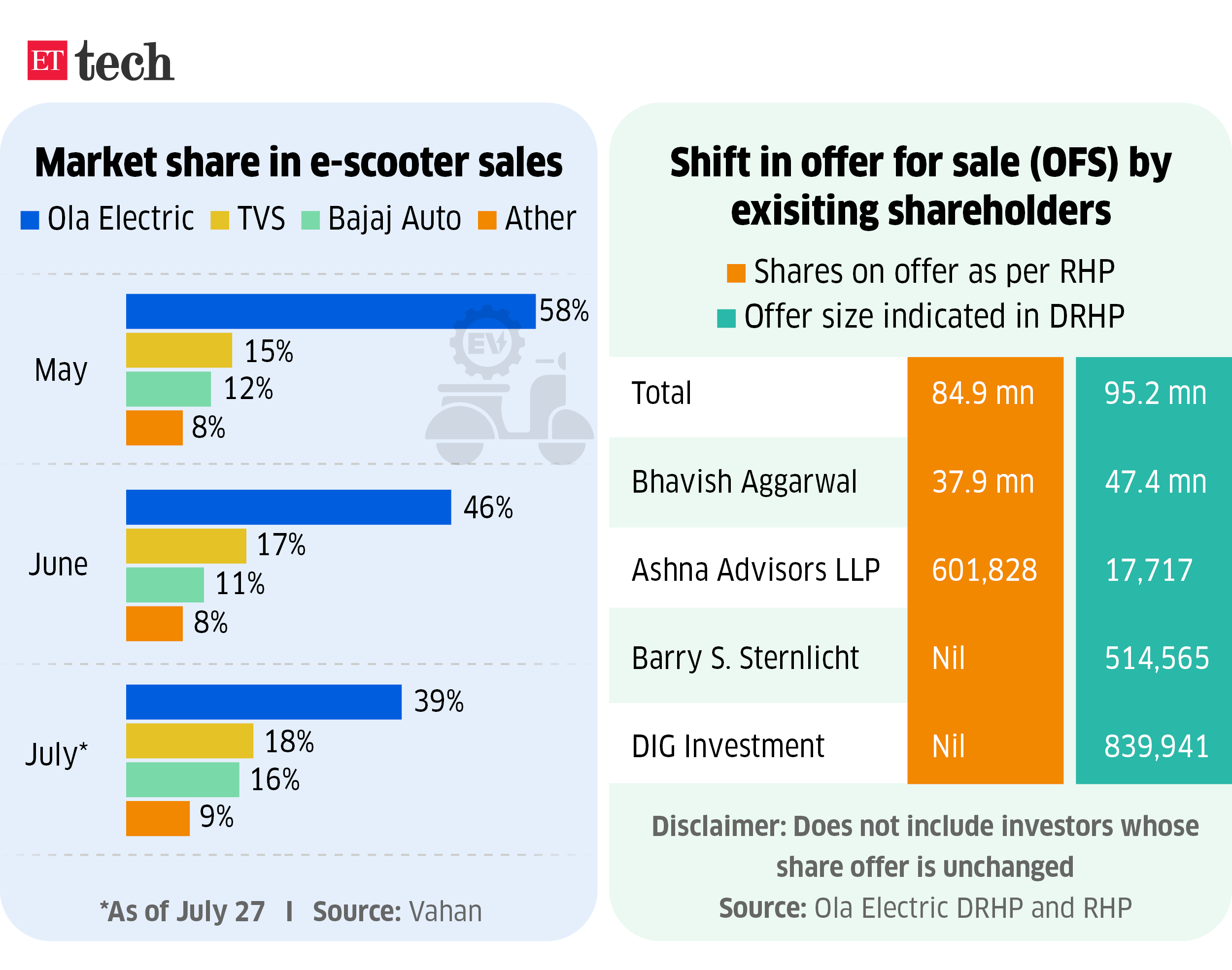

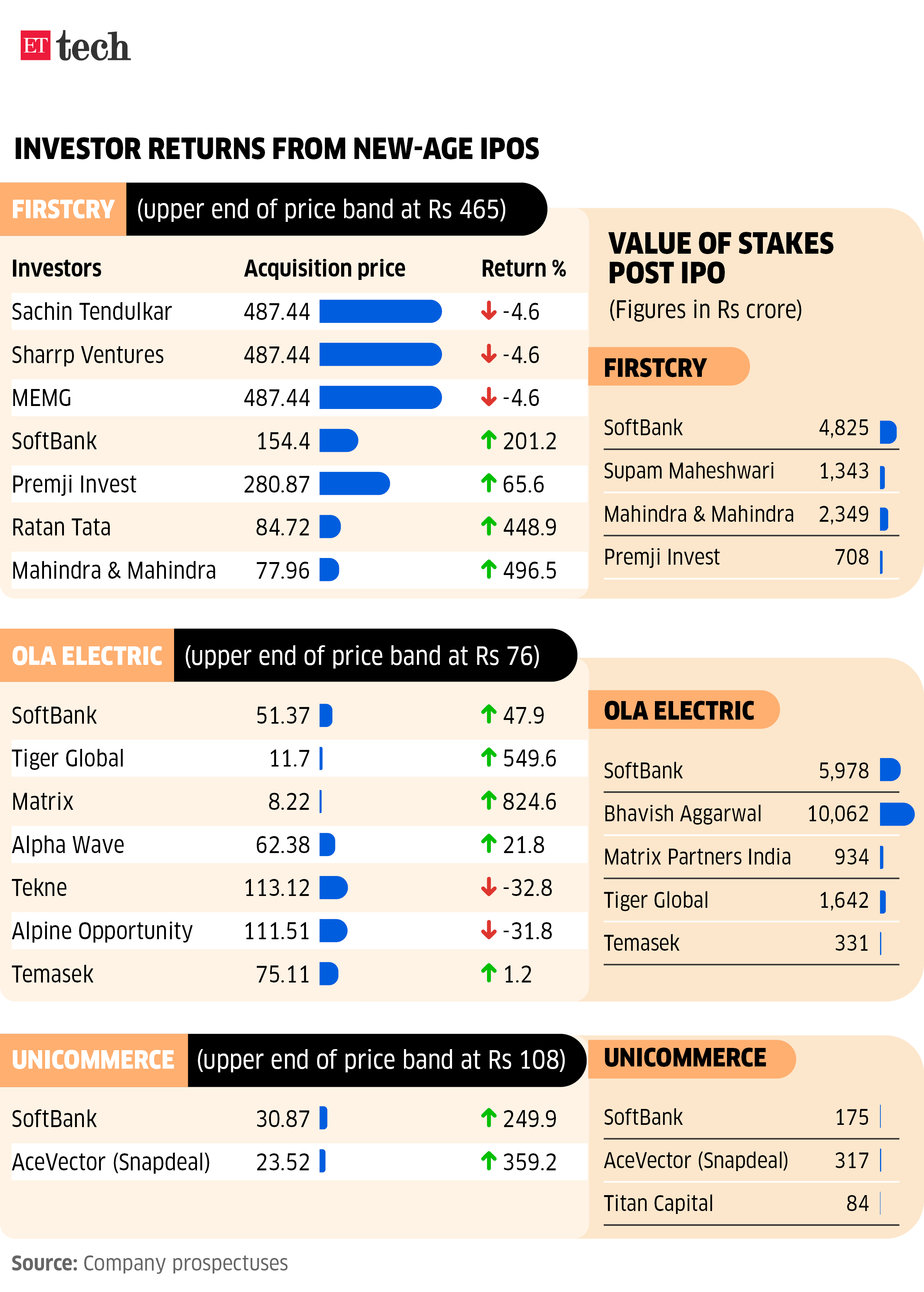

The Bhavish Aggarwal-led electric vehicle (EV) maker’s issue, set to be the largest so far this year, opened for subscription on August 2, with its retail portion getting fully subscribed within three hours. The SoftBank-backed company set a price band of Rs 72-76.

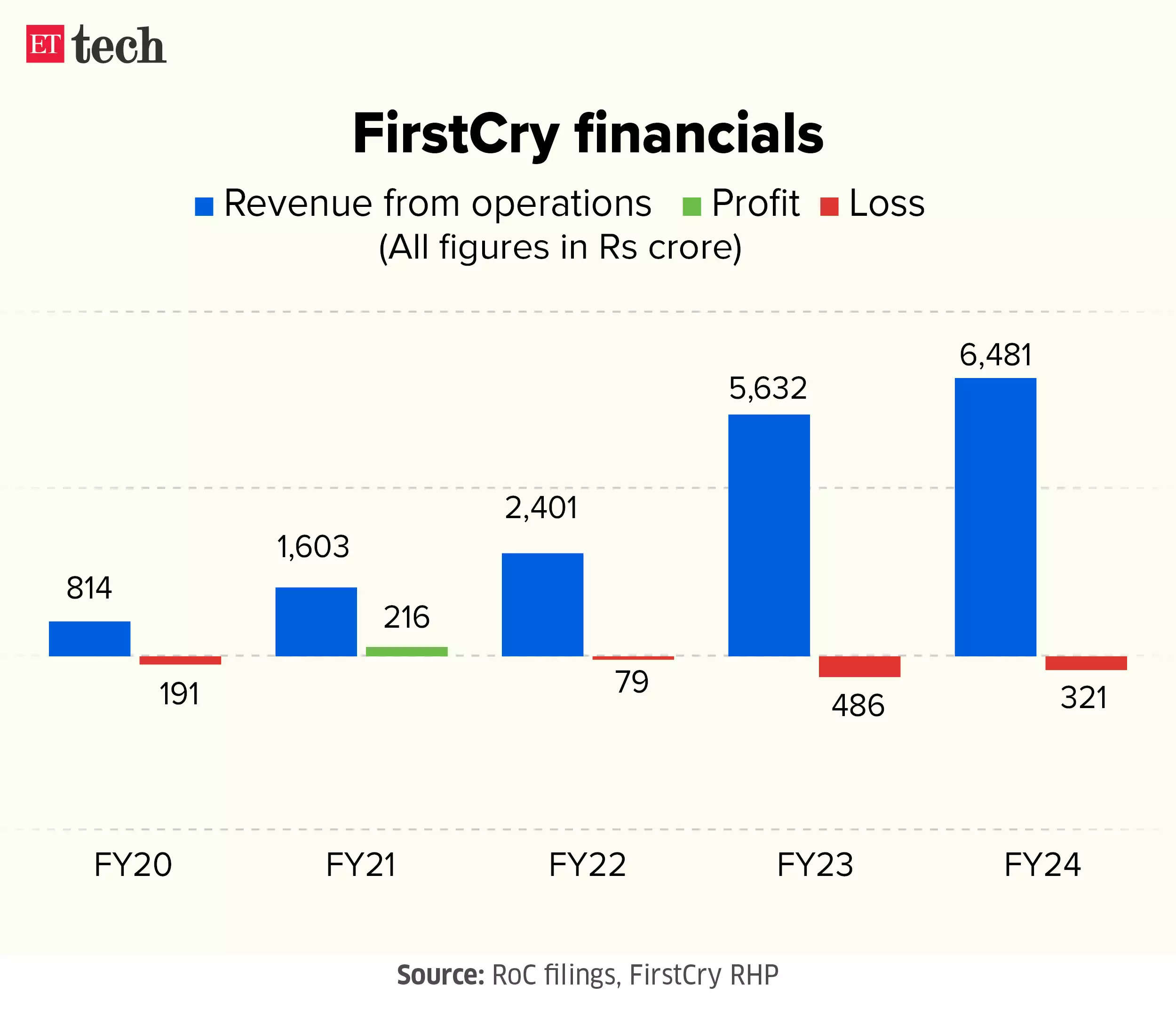

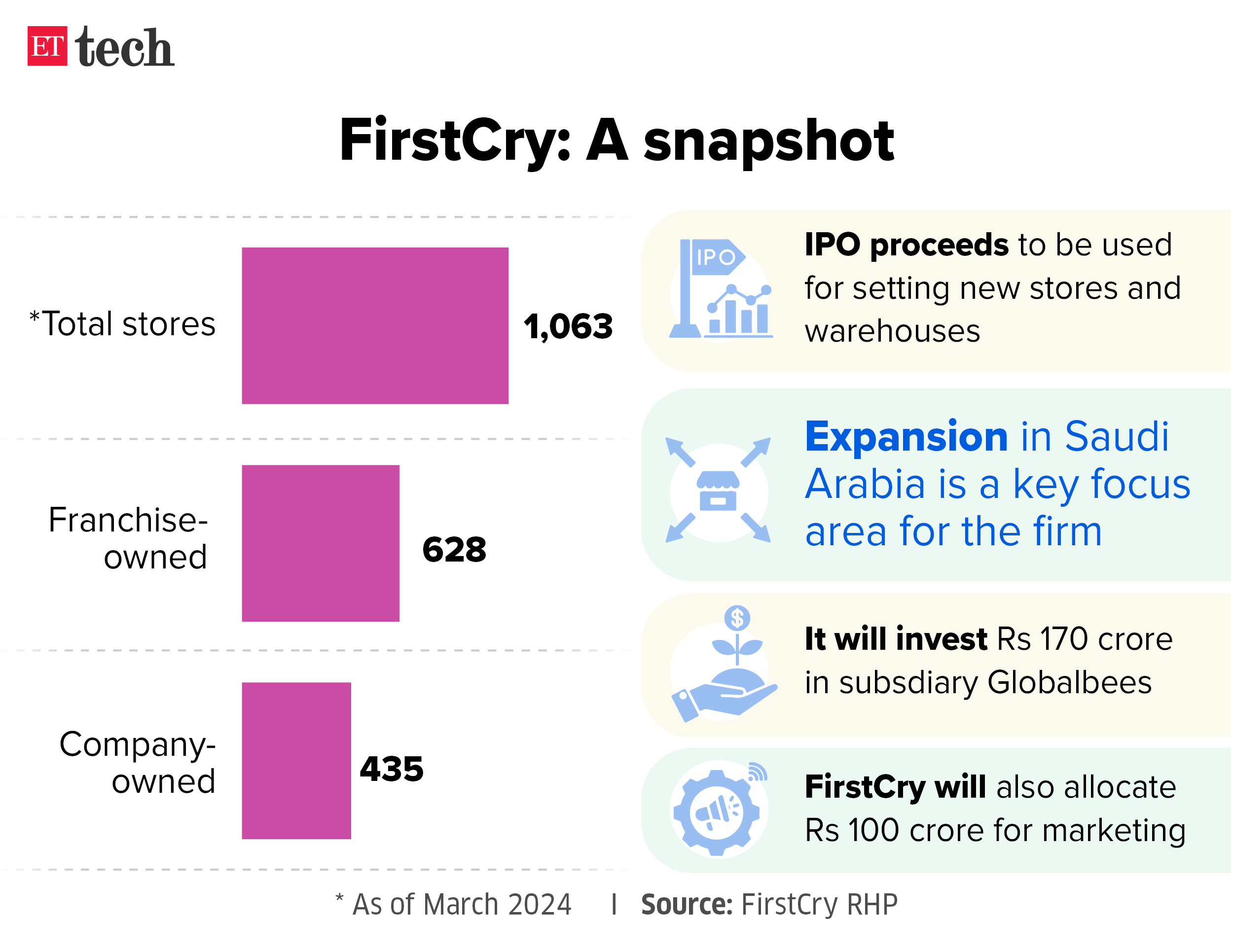

Meanwhile, FirstCry is set to open its IPO for subscription on August 6. The omnichannel retailer has fixed the share price at Rs 440-465 apiece.

IPO Watch

Ola Electric IPO subscribed 35%, retail portion at 157% on Day 1: The IPO of Ola Electric was subscribed 35% on the first day of the bidding process. The retail portion was over-subscribed 1.57 times. The non-institutional investor (NII) category was subscribed 20%.

On July 31, Aggarwal spoke to ET about the IPO’s lowered valuation and competition from legacy players in the EV space, among other things. “We are a four-five-year-old (company) and have scaled significantly. I wanted to make sure we price it attractively for the entire investor community in India,” he said. Read the full interview here.

FirstCry IPO at $2.9 billion valuation: Brainbees Solutions, which operates FirstCry, will float its IPO at a valuation of $2.9 billion. This is nearly a flat valuation for the SoftBank-backed firm which was last valued at $2.8 billion.

In an interview with ET on August 1, CEO Supam Maheshwari spoke about IPO pricing of new-age companies among other things.“It doesn’t really matter, to be honest (the IPO pricing). Cycles come and go, but great companies and great teams always persist, stay and create value for shareholders and for themselves,” he said.

Unicommerce IPO at $130 million valuation: Unicommerce Esolutions Ltd has set a price band of Rs 102-108 for its upcoming initial public offering that will launch on August 6. The Gurgaon-based company will list on the exchanges on August 13.

Also Read | AI firm Fractal eyes $400-500 million IPO at $3-billion valuation

Other Top Stories This Week

Salil Parekh, CEO, Infosys

Karnataka withdraws pre-show cause IGST notice to Infosys: Karnataka tax authorities on Wednesday issued a notice to Infosys for alleged evasion of over Rs 32,000 crore ($3.8 billion) in integrated goods and services tax (IGST). A day later, the company said in an exchange filing that the state authorities have withdrawn the notice. Sources however said that the probe against the company will now be carried by the Directorate General of GST Intelligence (DGGI).

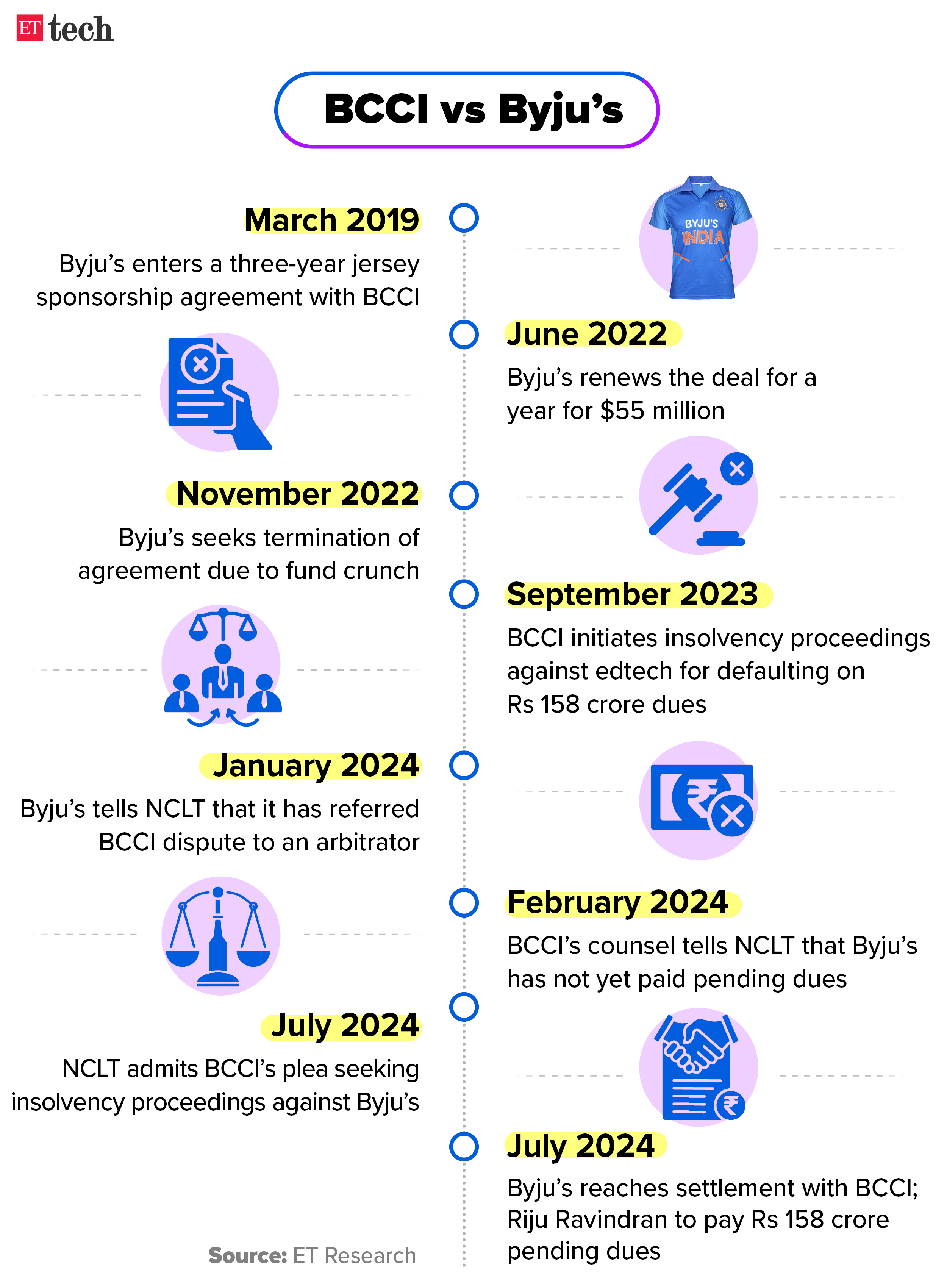

Byju’s averts insolvency proceedings as NCLAT allows settlement with BCCI: The Chennai bench of the NCLAT approved the settlement by the founders of edtech firm Byju’s of the Rs 158 crore payment arrears with the Board of Control for Cricket in India (BCCI). This helps founder Byju Raveendran avoid bankruptcy for the cash-strapped firm that’s also battling multiple investor cases in India as well as in the US.

The counsel representing US lenders had objected to the money paid by Riju Ravindran, seeking disclosure of source of funds. Ravindran’s legal team informed the bankruptcy appellate tribunal that he was using his personal funds for this settlement.

Tata Digital stitching ‘value fashion’ plan under its Cliq brand: Tata Digital, ecommerce arm of the Tata Group, is working on building a ‘value fashion’ proposition under its fashion and lifestyle marketplace Tata Cliq as it looks to challenge bigger rivals like Flipkart, Amazon India and Reliance Ajio, multiple people aware of the development said.

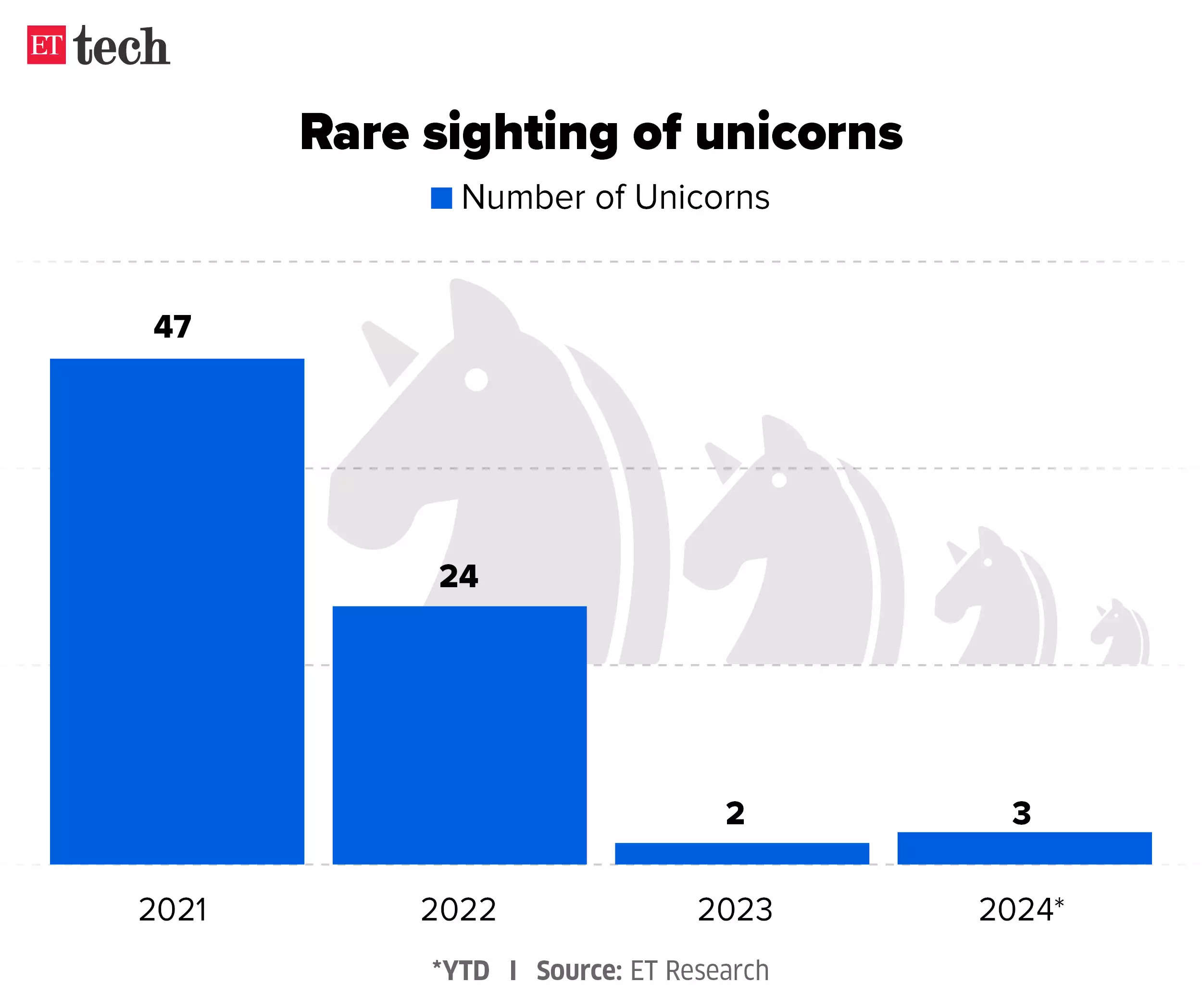

Rapido rolls into the unicorn club with $120 million from WestBridge: Rapido has become the latest homegrown startup to achieve unicorn status after the ride-hailing platform Rapido raised $120 million (about Rs 1,000 crore) in primary capital from existing investor WestBridge Capital at a post-money valuation of $1 billion.

In other news, the Karnataka Authority for Advance Rulings (AAR) has held that Rapido is liable to pay GST for its cab services, a ruling that potentially adds to the ambiguity over GST applicability on app-based mobility companies operating the subscription model.

Source of IT’s pain decoded: why clients are pulling back outsourced work in-house: The phenomenon of companies pulling back their outsourced technology work back in-house has started eating into the addressable market for third-party IT services companies.

It’s trending D2C: new-age brands flex muscle via own sites: The share of direct ecommerce — sales by brands through their websites, apps and social media — has grown to 10-15% of India’s online retail market of $70-75 billion now from 2-3% five years ago, according to industry data and analysts.

Earnings Corner

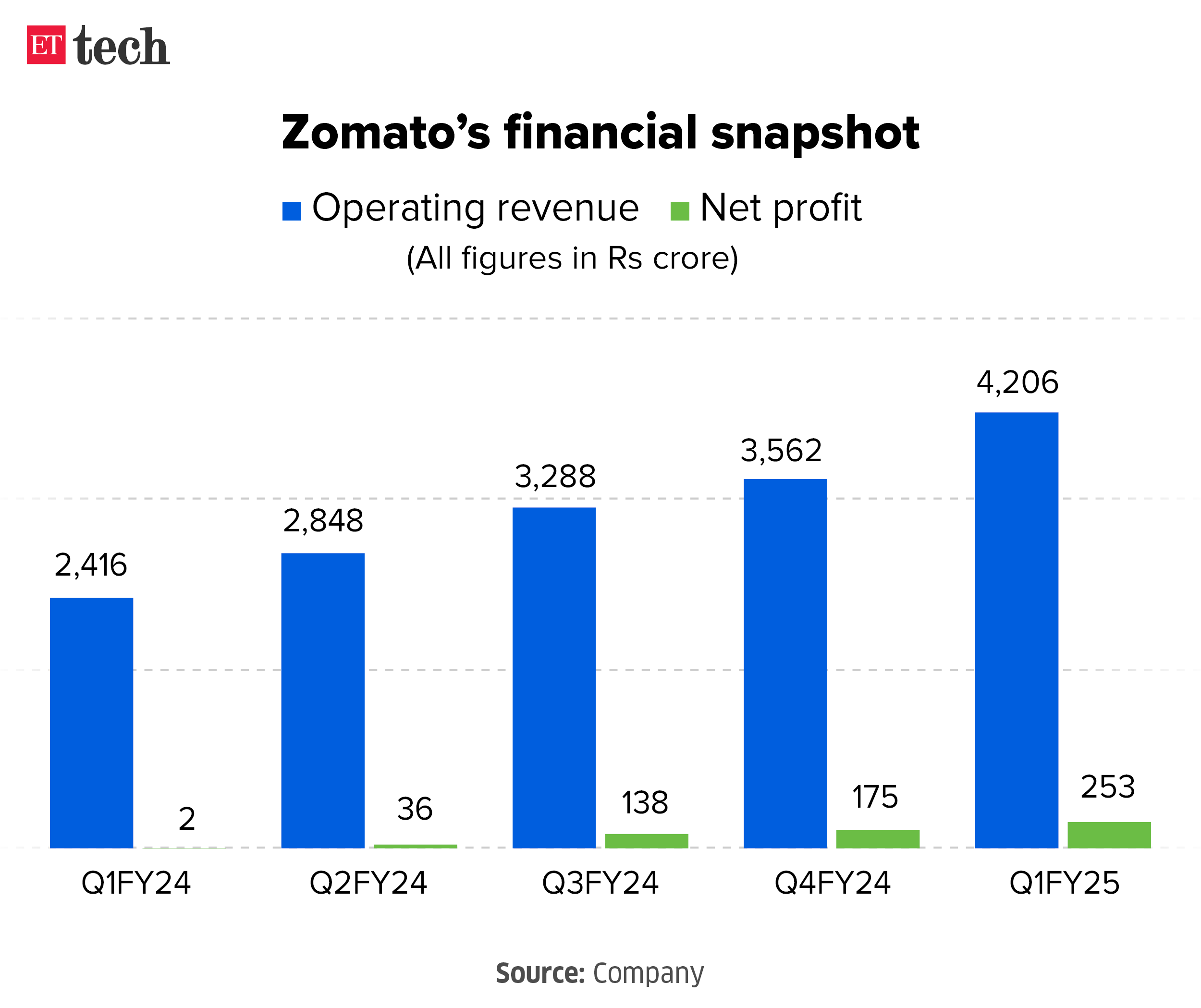

Zomato’s revenue rises 74% on Blinkit, Hyperpure surge: Food and grocery delivery company Zomato reported a Rs 253 crore net profit for the April-June quarter, compared with Rs 2 crore a year earlier, even as operating revenue rose 74% to Rs 4,206 crore. It announced the launch of District – a new app for its going-out business.

Delhivery posts Rs 54 crore in Q1 profit, revenue jumps 12% YoY: Logistics player Delhivery reported a profit after tax (PAT) of Rs 54 crore for the June 2024 quarter end, versus a loss of Rs 89 crore in the same quarter of the previous year.

Also Read | Ixigo’s Q4 revenue rises 16% to Rs 181.8 crore; net profit up

Cognizant Q2 profit up 22%, revenue flat: US-headquartered IT and professional services firm Cognizant posted a 22.2% year-on-year (YoY) growth in net profit at $566 million for the second quarter ending June 2024.

Fintech News

Tax filings more challenging on surge in F&O, gaming app play: A massive jump in speculation in the futures and options (F&O) market and betting through gaming apps is throwing up a problem of a different kind.

P2P firms dial RBI for secondary market access, instant liquidity tools: The peer-to-peer lending sector, in its efforts to become an attractive wealth management tool for investors with the right risk appetite, has sought clarity from the RBI on certain features around instant liquidity, flow of funds between borrowers and lenders and automatic reinvestment of gains.

Paytm to focus on profitability despite fewer digital payment incentives in budget: One 97 Communications, which owns fintech firm Paytm, remains focused on achieving profitability in at least one quarter this financial year, despite fewer incentives for digital payments via RuPay debit cards and UPI in the budget, founder and CEO Vijay Shekhar Sharma said.

Also Read | Amazon Pay, Adyen, BillDesk secure cross-border payment licence from RBI

Tech Policy

Smaller cities are stealing the show in data centre expansion: India’s fast-expanding data centre industry is evolving beyond traditional hubs and expanding to emerging hotspots such as Kochi, Jaipur, Ahmedabad, Lucknow, Patna and Visakhapatnam as companies look to serve a growing but distributed user base across the country.

DPDP final draft to be ready for public review in two weeks: The government has finalised the draft of the rules proposed to be enacted under the Digital Personal Data Protection (DPDP) Act 2023 and hopes to release them for public consultation in the second or third week of August, sources told ET.