Germany’s DAX index recently reached a fresh peak as inflation slowed, supporting the case for potential interest rate cuts by the European Central Bank. Amid this positive economic backdrop, investors are increasingly looking at high-growth tech stocks that show strong fundamentals and innovative potential.

|

Name |

Revenue Growth |

Earnings Growth |

Growth Rating |

|---|---|---|---|

|

Formycon |

31.78% |

30.52% |

★★★★★☆ |

|

Ströer SE KGaA |

7.39% |

29.86% |

★★★★★☆ |

|

Stemmer Imaging |

13.34% |

23.20% |

★★★★★☆ |

|

Exasol |

14.66% |

117.10% |

★★★★★☆ |

|

ParTec |

41.16% |

63.31% |

★★★★★★ |

|

medondo holding |

34.52% |

71.99% |

★★★★★☆ |

|

Northern Data |

32.53% |

68.17% |

★★★★★☆ |

|

cyan |

27.51% |

67.79% |

★★★★★☆ |

|

Rubean |

59.40% |

73.87% |

★★★★★☆ |

|

asknet Solutions |

20.06% |

74.86% |

★★★★★☆ |

Let’s explore several standout options from the results in the screener.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Formycon AG is a biotechnology company that develops biosimilar drugs in Germany and Switzerland, with a market cap of €926.99 million.

Operations: Formycon AG focuses on developing biosimilar drugs, generating €60.80 million in revenue from its Drug Delivery Systems segment.

Formycon, a German biotech firm, reported H1 2024 sales of €26.89 million, down from €43.79 million the previous year, with a net loss of €10.09 million compared to a net income of €1.8 million in H1 2023. Despite this setback, the company is forecasted to achieve significant revenue growth at 31.8% annually and earnings growth at 30.5%, outpacing the German market averages significantly. Notably, Formycon’s R&D expenses have been robust, reflecting its commitment to innovation and long-term value creation in biosimilars development.

Simply Wall St Growth Rating: ★★★★☆☆

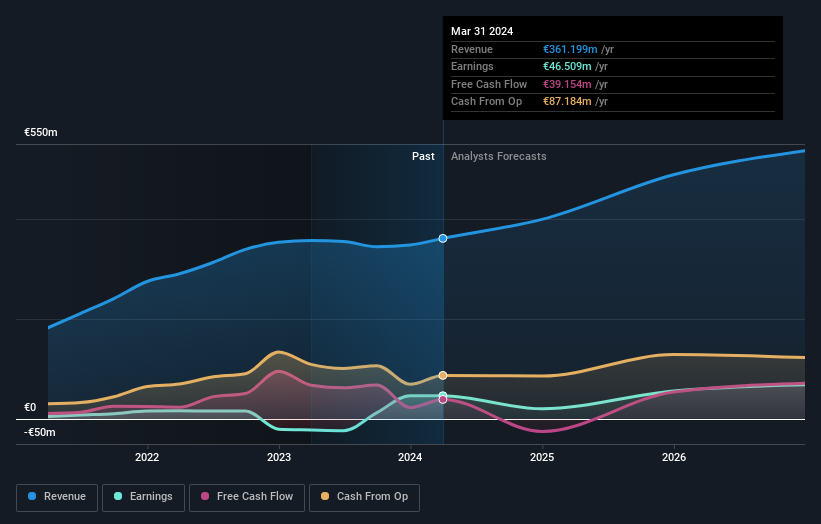

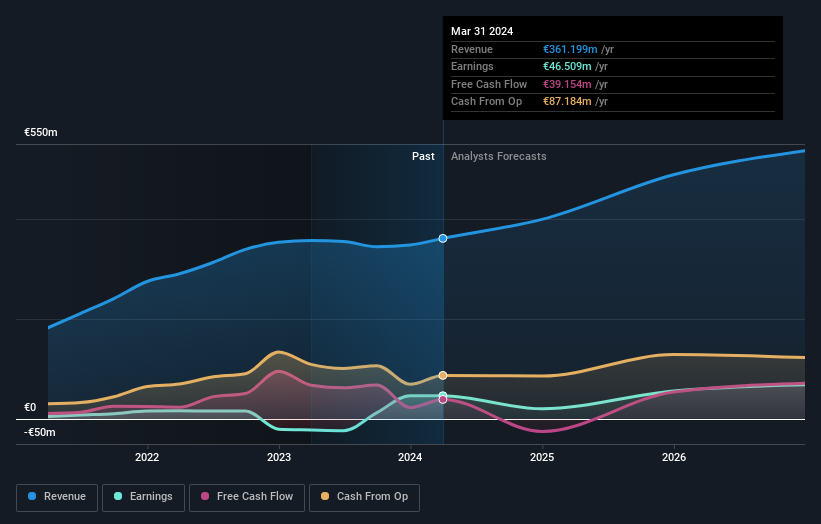

Overview: Verve Group SE operates a software platform for the automated buying and selling of digital advertising space in North America and Europe, with a market cap of €594.48 million.

Operations: Verve Group SE generates revenue primarily through its Supply Side Platforms (SSP) at €341.35 million and Demand Side Platforms (DSP) at €57.59 million, with a segment adjustment of -€42.85 million. The company focuses on the automated buying and selling of digital advertising space across North America and Europe.

Verve Group SE, a German tech firm, reported a significant revenue increase to €192.09 million for H1 2024 from €158.57 million in the previous year, while net income surged to €6.86 million compared to €2.57 million last year. The company raised its annual revenue guidance to between €400 million and €420 million and forecasts earnings growth at 20.5% annually, outpacing the German market’s 19.7%. With R&D expenses reflecting their commitment to innovation and long-term value creation, Verve’s strategic moves such as acquiring Jun Group have bolstered its demand-side capabilities significantly.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SAP SE, along with its subsidiaries, offers a range of applications, technology, and services globally and has a market cap of approximately €231.15 billion.

Operations: SAP SE generates revenue primarily through its Applications, Technology & Services segment, which brought in €32.54 billion. The company’s business model focuses on providing comprehensive software solutions and technological services to a global clientele.

SAP’s recent financial performance shows a mixed picture with revenue increasing to €16.33 billion for H1 2024, up from €14.99 billion last year, but net income dropped to €94 million from €3.49 billion due to a significant one-off loss of €3.3 billion. The company’s R&D expenses reflect its commitment to innovation, with investments totaling 10% of its revenue, ensuring continuous development in AI and cloud solutions like SAP S/4HANA Cloud and SAP Business Technology Platform (BTP). Notably, SAP repurchased shares worth €1.87 billion in the past year, indicating strong cash flow management and shareholder value focus despite executive board changes affecting strategic directions in technology and innovation areas.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:FYB XTRA:M8G and XTRA:SAP.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com