Top Stories This Week

How Sebi action will impact profits of discount stock broking firms like Zerodha and Groww: The Securities and Exchange Board of India’s July 1 circular is set to affect the revenue pools of stockbrokers and could eventually impact valuations of fintech startups operating in this space.

Also Read | Zerodha’s Nithin Kamath sees end of road for zero brokerage model after new Sebi rules

Food watchdog wants quick commerce companies to speed with caution: The government has stepped up unscheduled audits and spot checks on dark stores of leading quick commerce platforms, especially for packaged foods, after several hygiene lapses came to light in recent weeks, said people familiar with the matter.

Purplle closes Rs 1,000 crore funding deal led by Abu Dhabi Investment Authority: Beauty retailer Purplle has closed a Rs 1,000-crore ($120 million) round led by sovereign fund Abu Dhabi Investment Authority (ADIA), signalling a revival in big-ticket funding for Indian startups as well as a rising interest in the fast-growing consumer sector.

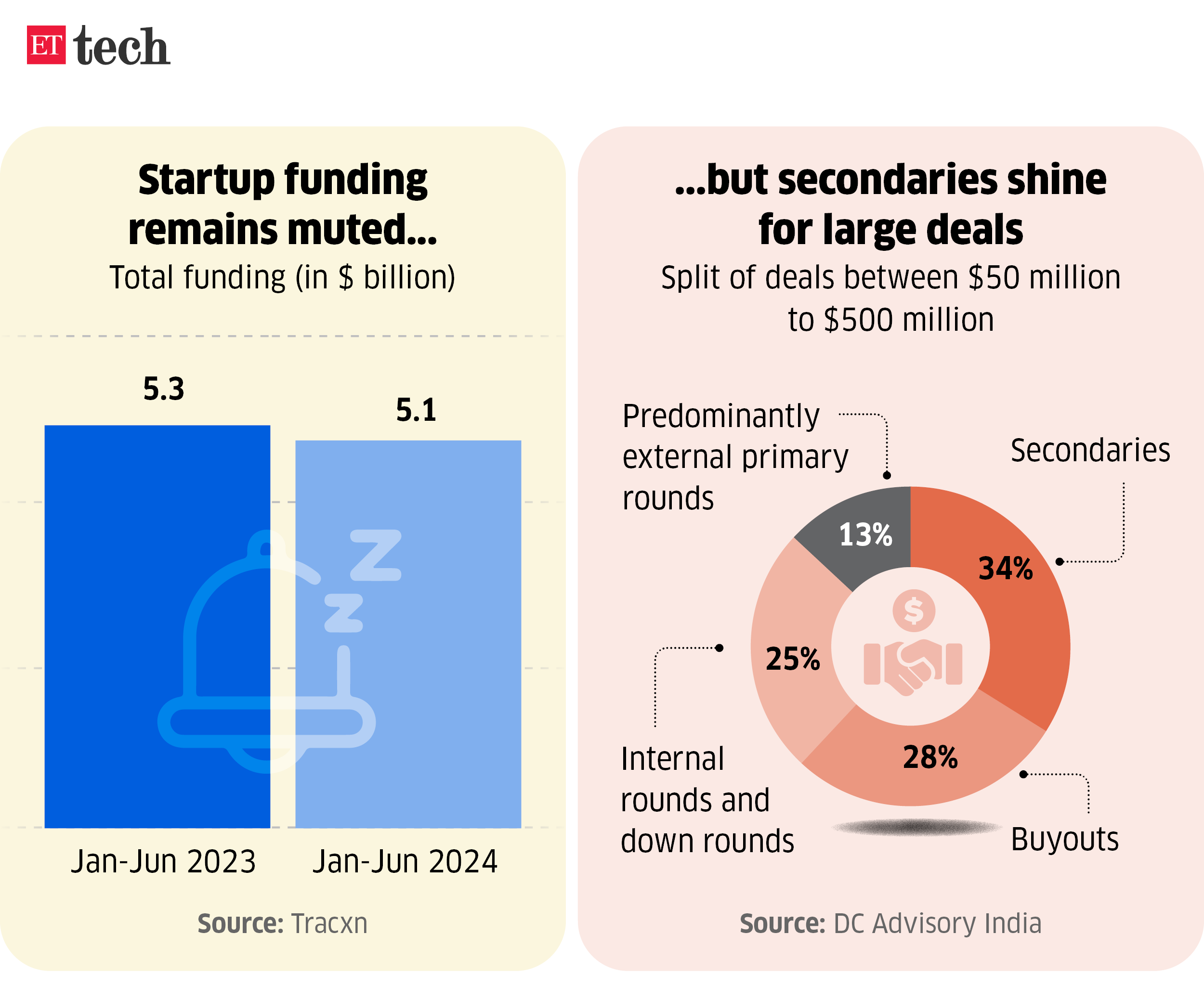

PE, VC funding slows in first half of 2024; secondary deals become prominent: Secondary stake sales and buyouts dominated large deals of $50-500 million in the startup space during the first six months of 2024, when total funding fell but late-stage activities started to pick up pace.

Total funding for startups fell by 3.8% to about $5.1 billion in the six months, compared with $5.3 billion in the same period in 2023, data from Tracxn showed.

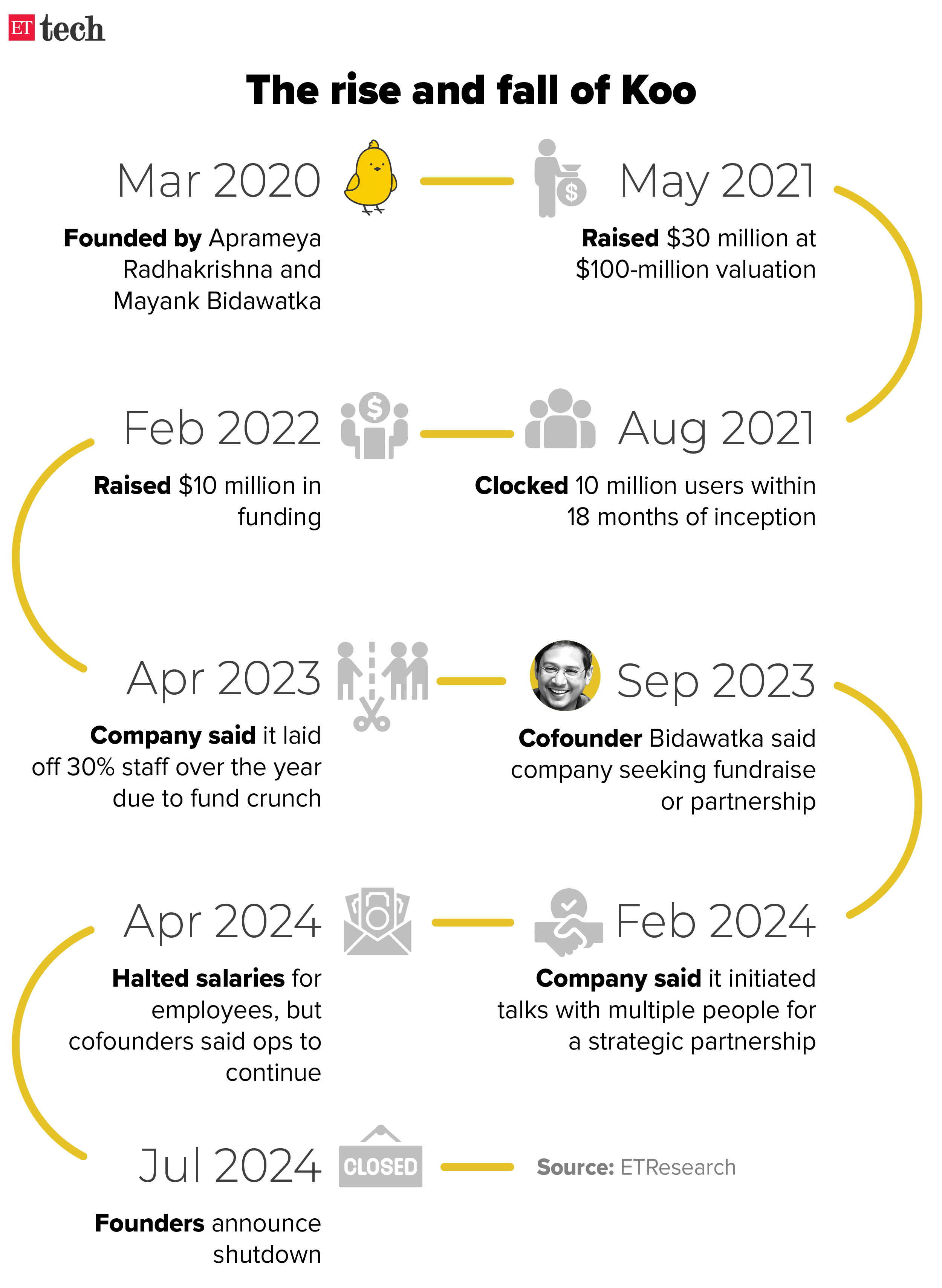

Indian Twitter rival Koo shuts down after failed acquisition talks: Indian social media app Koo, once seen as a rival to micro-blogging platform X, is shutting down, its founder, Aprameya Radhakrishna, said in a post on LinkedIn on Wednesday.

The founders’ decision comes after several rounds of talks for a potential sale or merger with multiple companies, including Dailyhunt, failed, people aware of the matter said.

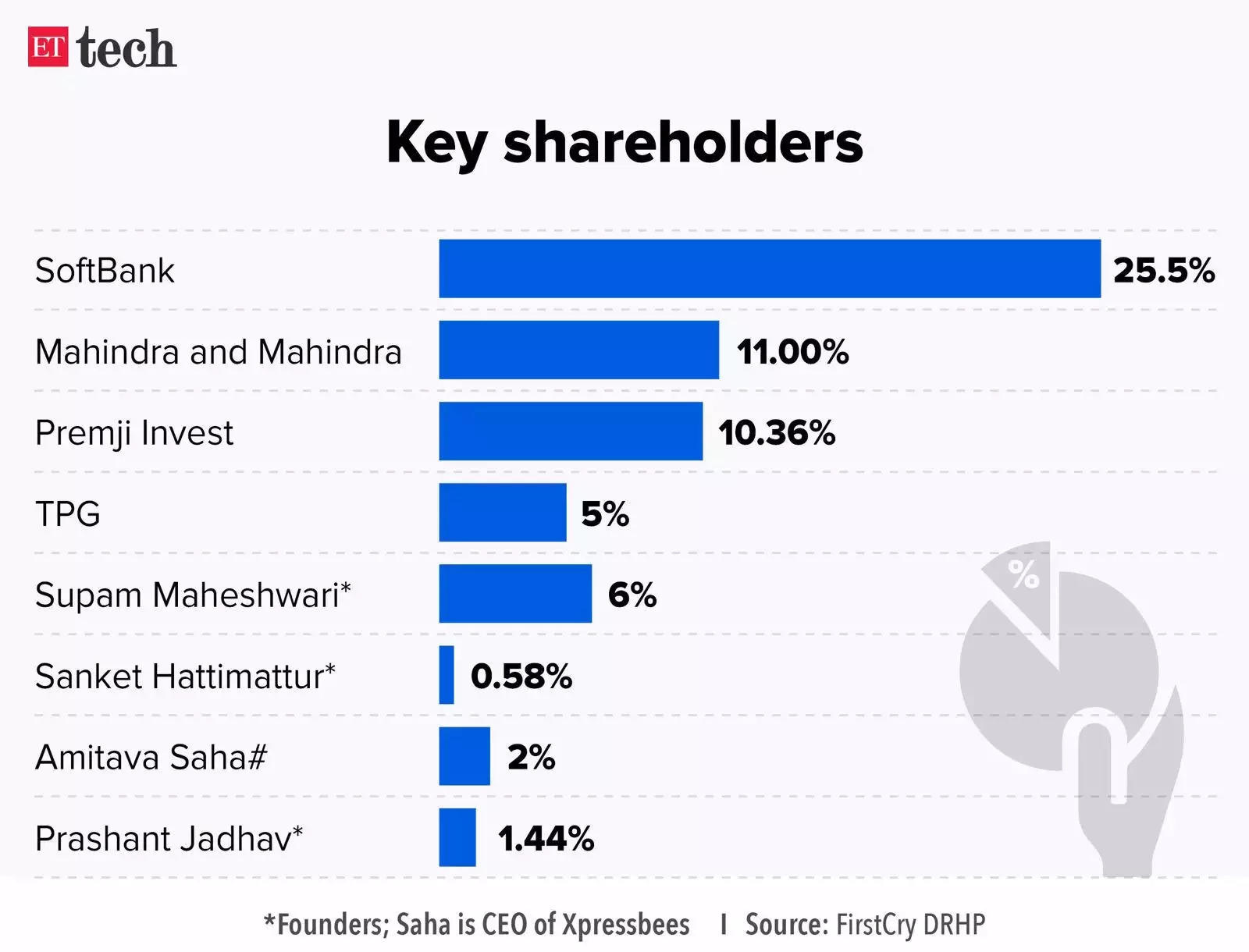

Sebi clears FirstCry and Unicommerce IPO: The Securities and Exchange Board of India (Sebi) has cleared IPO proposals of two portfolio firms of SoftBank–omnichannel baby products retailer FirstCry and ecommerce enterprise software developer Unicommerce, according to the market regulator.

Food Corner

Zomato suspends hyperlocal goods delivery service Xtreme, restarts intercity deliveries: sources | Gurgaon-based Zomato has suspended its hyperlocal goods delivery service ‘Xtreme’ on account of poor demand, according to people aware of the matter. The food delivery platform had launched the service in October last year.

Separately, Zomato has received shareholders’ approval to expand its employee stock option plan (Esop) and has withdrawn its application for a non-banking financial company (NBFC) licence, it said in two separate filings with stock exchanges.

F&B, quick commerce log 40-50% sales jump on T20 final night: F&B and quick commerce companies saw an upto 40%-50% uptick in sales and revenues on Saturday night thanks to the T20 World Cup final and India’s victory against South Africa. Merchant checkout network Simpl said it saw a nearly 40% increase in consumer spending on its platform during the match.

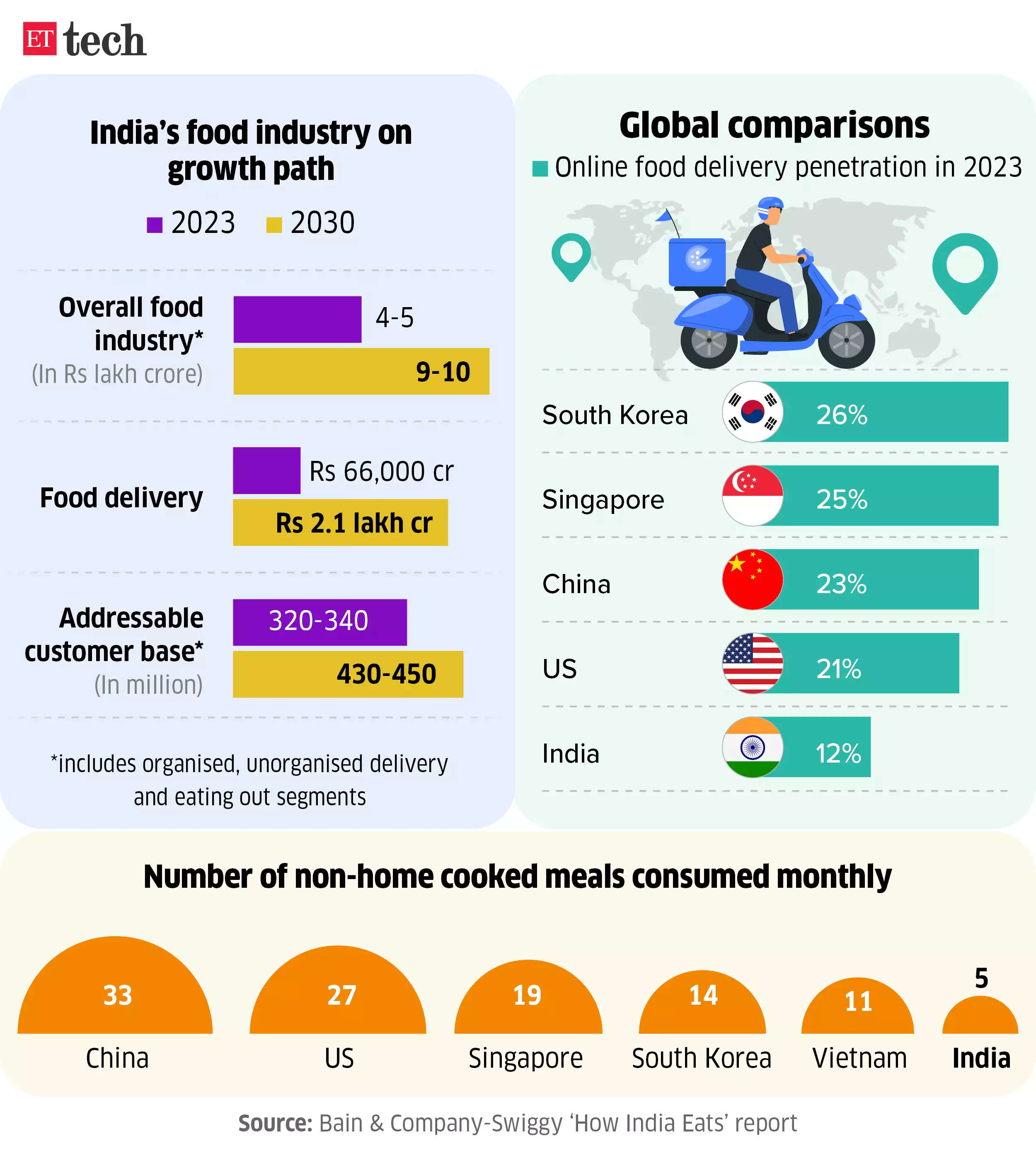

Food delivery market size to cross Rs 2 lakh crore by 2030: Bain-Swiggy report | India’s food delivery segment is expected to cross Rs 2 lakh crore by 2030, growing at a compound annual growth rate of 18%, a joint report by Bain & Company and Swiggy said.

Fintech News

Alok Bansal and Yashish Dahiya, founders, PB Fintech group

Global firms buy PB Fintech stakes from early backers: American financial services major Capital Group, and asset management companies T Rowe Price, Fidelity and Vanguard have all acquired stakes in PB Fintech, which runs insurance marketplace Policybazaar and credit marketplace Paisabazaar, people in the know said.

Top fintechs dial NBFCs for secured credit partnerships: After establishing themselves as a reliable sourcing channel for unsecured consumer credit, fintech startups are now trying to tap into the secured credit market. Players like PhonePe, Cred and Paytm are looking for partnerships with non-banking finance companies (NBFCs) to process such loans.

ONDC to add banks, fintechs to take credit services to last mile: Open Network for Digital Commerce (ONDC) is set to integrate banks such as HDFC Bank, IDFC First Bank and Karnataka Bank, alongside fintech firms like Fibe, in the coming months, sources told ET.

IT Updates

Indian software sector earnings will remain modest in Q1: here’s why | India’s top software service providers are set to report a modest uptick in average growth in the first quarter, with Infosys and LTIMindtree leading the pack in a minor reshuffle of the performance leader-board.

Strong ER&D demand helps IT buck overall soft hiring trend: An upward curve in demand for engineering, research and development (ER&D) services is boosting hiring prospects in the space by around 15% when recruitment in general continues to remain soft in India’s $250 billion IT services industry.

Why Indian IT companies are moving into New Jersey: New Jersey is emerging as the new hub for Indian IT companies, their top executives and many of the Indian-origin engineers who work in the US. India is New Jersey’s second-largest foreign direct investor and the majority of New Jersey’s immigrant population hails from India.

Tech Policy

On A(I) Mission, Centre may go with Indian intel: The government may prefer Indian data centre companies to run and manage the operations of graphics processing units (GPUs) to be procured under the Rs 10,372 crore India AI Mission, according to people aware of the matter.

Foxconn’s Bharat FIH is facing turbulence due to top-level exits: Foxconn group’s Bharat FIH is weathering a rough spell, having lost three independent directors in the last three months. The company is also likely to shutter its manufacturing facility in Sri City, Andhra Pradesh, due to a massive drop in orders from key client Xiaomi.

Other Top Stories