As the European markets experience a boost from the Paris Olympics and growing optimism around potential interest rate cuts by the ECB, France’s CAC 40 Index has gained momentum, reflecting positive sentiment among investors. In this favorable environment, identifying high-growth tech stocks becomes crucial for capitalizing on market opportunities; these stocks often exhibit strong revenue growth, innovative products or services, and robust market positioning.

|

Name |

Revenue Growth |

Earnings Growth |

Growth Rating |

|---|---|---|---|

|

Icape Holding |

16.18% |

35.08% |

★★★★★☆ |

|

Cogelec |

11.32% |

24.06% |

★★★★★☆ |

|

VusionGroup |

21.32% |

25.74% |

★★★★★★ |

|

Munic |

26.68% |

149.17% |

★★★★★☆ |

|

Adocia |

59.08% |

63.00% |

★★★★★★ |

|

Oncodesign Société Anonyme |

14.68% |

101.18% |

★★★★★☆ |

|

Valneva |

24.22% |

28.34% |

★★★★★☆ |

|

Pherecydes Pharma Société anonyme |

63.30% |

78.85% |

★★★★★☆ |

|

OSE Immunotherapeutics |

30.02% |

5.91% |

★★★★★☆ |

|

beaconsmind |

31.75% |

106.73% |

★★★★★★ |

Let’s uncover some gems from our specialized screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Esker SA operates a cloud platform for finance and customer service professionals in France and internationally, with a market cap of €1.39 billion.

Operations: Esker SA generates revenue primarily through its software and programming services, amounting to €190.92 million. The company focuses on providing cloud solutions for finance and customer service sectors across various regions.

Software firms are increasingly moving to SaaS models, ensuring recurring revenue from subscriptions. Esker’s earnings are forecast to grow 25.4% annually, outpacing the French market’s 12.3%. Despite a recent 16.8% earnings drop, its R&D expenses of €24 million (€1.2 billion market value) highlight a commitment to innovation in AI and automation solutions for clients like TSMC and Apple. The company repurchased shares this year, signaling confidence in its growth trajectory amidst M&A rumors involving Bridgepoint Group.

Simply Wall St Growth Rating: ★★★★☆☆

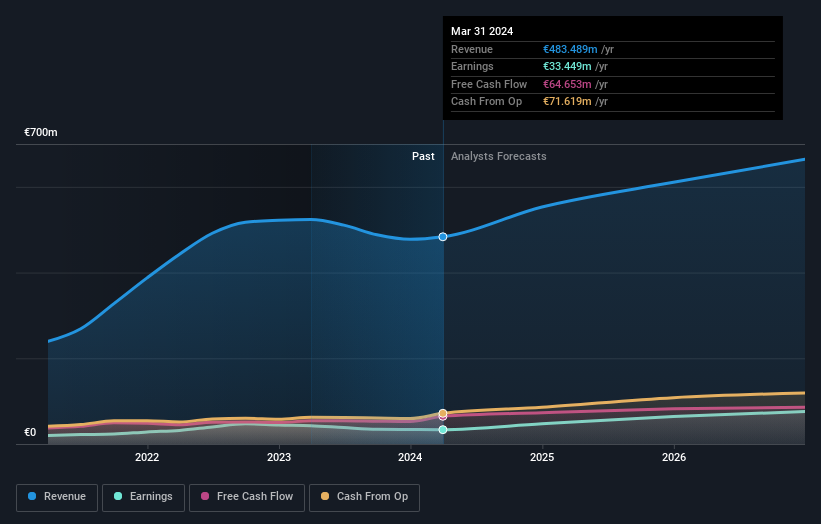

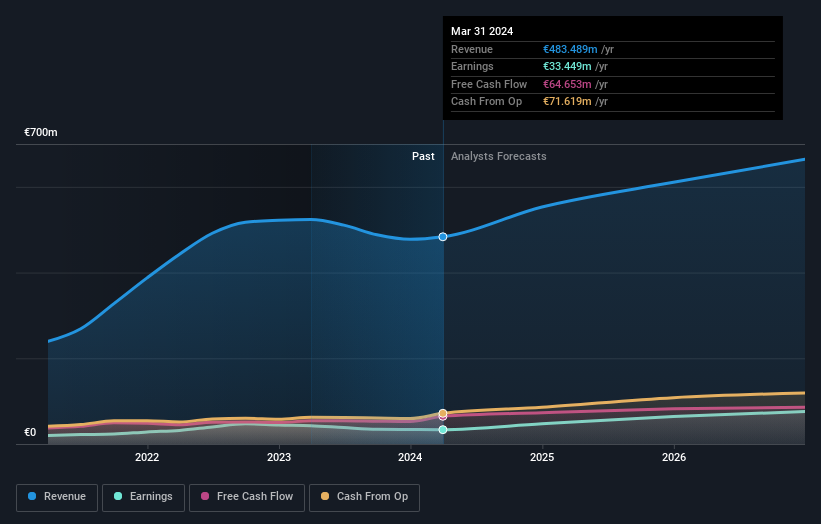

Overview: Lectra SA provides industrial intelligence solutions for the fashion, automotive, and furniture markets across Northern Europe, Southern Europe, the Americas, and the Asia Pacific with a market cap of €1.04 billion.

Operations: Lectra generates revenue primarily from the Americas (€172.65 million) and Asia-Pacific (€118.54 million), focusing on industrial intelligence solutions for various markets. The company’s cost structure and profit margins are not detailed in the provided data, limiting further financial analysis.

Lectra’s recent earnings report shows a sales increase to €262.29 million, up from €239.55 million last year, though net income dropped to €12.51 million from €14.47 million. The company’s R&D expenses highlight innovation efforts, particularly in AI and automation for fashion and automotive sectors; these investments are crucial as earnings are projected to grow 29.3% annually, outpacing the French market’s 12.3%. With revenue growth forecasted at 10.4% per year, Lectra remains a notable player in high-growth tech despite recent challenges.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vivendi SE is a global entertainment, media, and communication company with operations spanning France, Europe, the Americas, Asia/Oceania, and Africa; it has a market cap of approximately €10.04 billion.

Operations: Vivendi SE generates revenue through various segments, including Canal+ Group (€6.20 billion), Havas Group (€2.92 billion), and Gameloft (€304 million). The company is diversified across entertainment, media, and communication sectors globally.

Vivendi’s revenue is forecasted to grow at 9.3% annually, outpacing the French market’s 5.8%. Despite a slight dip in net income to €159 million for H1 2024, the company has shown resilience with significant earnings growth projections of 30.6% per year. The media conglomerate’s R&D expenditure underscores its commitment to innovation, particularly in AI and digital transformation sectors. Recent share repurchases totaling €184 million reflect strong confidence in future prospects, bolstered by Canal+’s potential London listing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:ALESK ENXTPA:LSS and ENXTPA:VIV.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com