As global markets celebrate the Federal Reserve’s announcement of impending interest rate cuts, small-cap stocks have outperformed their larger counterparts, buoyed by broad-based gains. In this dynamic environment, identifying high-growth tech stocks becomes crucial for investors looking to capitalize on market optimism and favorable economic conditions.

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| TG Therapeutics | 28.62% | 43.05% | ★★★★★★ |

| Sarepta Therapeutics | 24.22% | 44.94% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.97% | 30.50% | ★★★★★★ |

| Facilities by ADF | 32.33% | 94.46% | ★★★★★★ |

| G1 Therapeutics | 27.57% | 57.75% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 22.90% | 28.13% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Adveritas | 66.47% | 103.87% | ★★★★★★ |

| Adocia | 59.08% | 63.00% | ★★★★★★ |

Click here to see the full list of 1279 stocks from our High Growth Tech and AI Stocks screener.

Let’s uncover some gems from our specialized screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Genmab A/S develops antibody therapeutics for the treatment of cancer and other diseases primarily in Denmark, with a market cap of DKK118.23 billion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to DKK19.02 billion. The focus is on developing antibody therapeutics for cancer and other diseases.

Genmab’s recent conditional marketing authorization for TEPKINLY® in the EU highlights its innovative approach in treating relapsed or refractory follicular lymphoma. The company reported a 21.2% annual earnings growth, surpassing the Danish market’s 14.2%. Additionally, Genmab’s revenue is forecasted to grow at 14.6% annually, reflecting strong future prospects despite a slower pace than other high-growth tech sectors. Significant R&D investments bolster these advancements; their commitment to innovation is evident with DKK 3,579 million spent on share repurchases this year alone.

Simply Wall St Growth Rating: ★★★★★☆

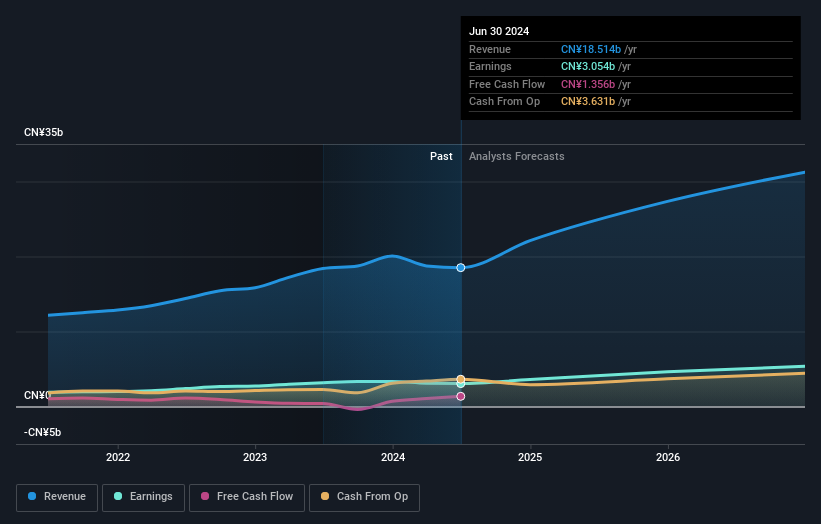

Overview: AVIC Jonhon Optronic Technology Co., Ltd. specializes in the research and development of optical, electrical, and fluid connection technologies and equipment in China, with a market cap of CN¥73.05 billion.

Operations: AVIC Jonhon Optronic Technology Co., Ltd. focuses on the development and production of advanced optical, electrical, and fluid connection technologies and equipment in China. The company operates within a market cap of CN¥73.05 billion, generating significant revenue from its specialized technological solutions.

AVIC Jonhon Optronic Technology Ltd. is poised for robust growth, with revenue expected to increase by 21.3% annually, outpacing the Chinese market’s 13.4%. Despite a recent dip in sales to ¥9.20 billion for H1 2024 from ¥10.76 billion the previous year, earnings are forecasted to grow at an impressive rate of 23.1% per year over the next three years, surpassing the industry average of -6.3%. Notably, their R&D expenses reflect a strong commitment to innovation and future potential within high-growth tech sectors.

Simply Wall St Growth Rating: ★★★★★☆

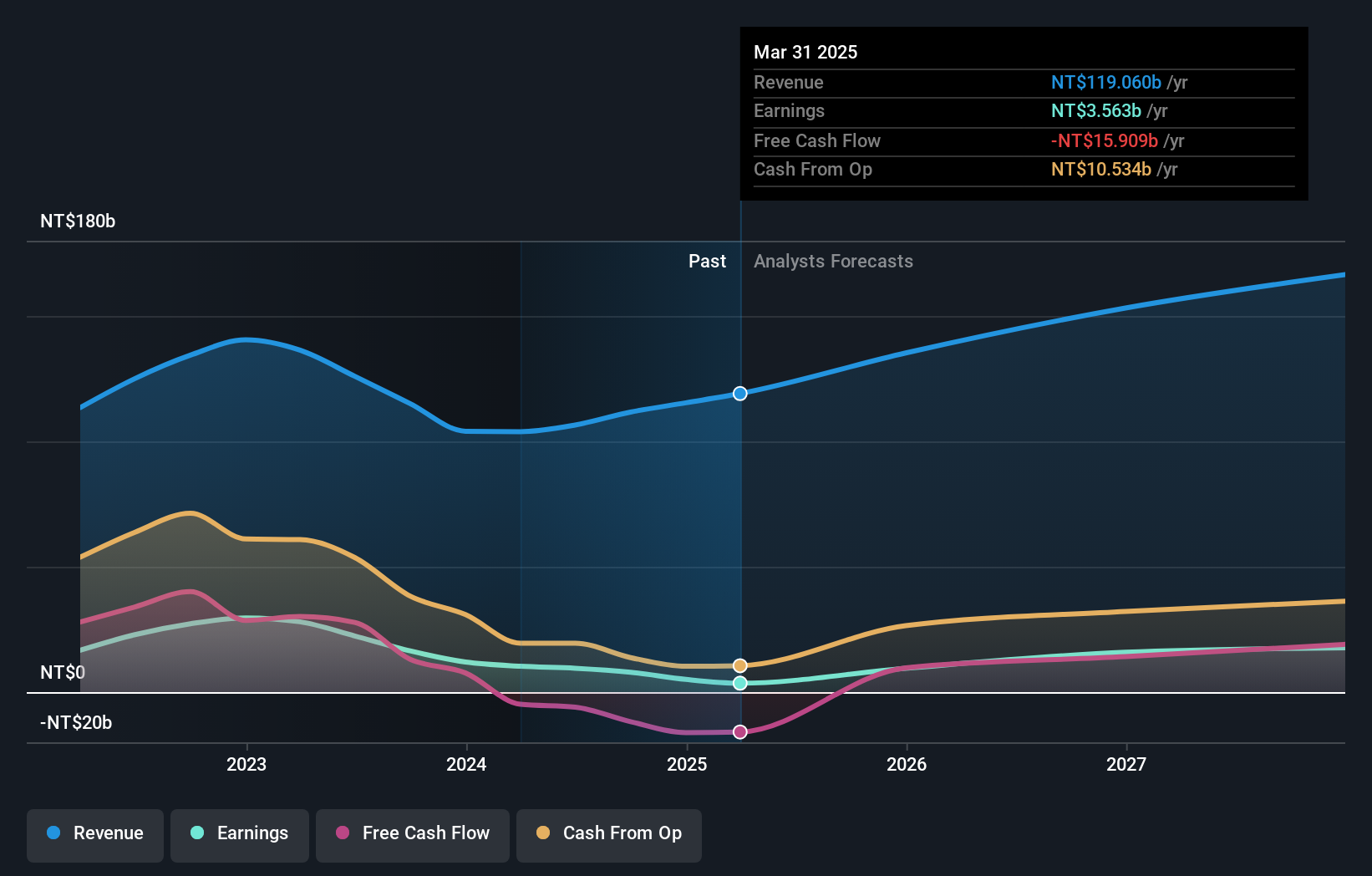

Overview: Unimicron Technology Corp. develops, manufactures, processes, and sells printed circuit boards, electrical equipment, electronic products, and testing and burn-in systems for integrated circuit products worldwide with a market cap of NT$243.81 billion.

Operations: Unimicron Technology Corp. focuses on the development, manufacturing, and sale of printed circuit boards, electrical equipment, electronic products, and integrated circuit testing systems globally. The company operates with a market cap of NT$243.81 billion.

Unimicron Technology’s revenue is projected to rise by 19.2% annually, outpacing the Taiwan market’s 11.8%. Despite a recent net income of TWD 1.60 billion for Q2 2024, down from TWD 2.39 billion last year, the company remains focused on innovation with significant R&D investments. Their earnings are expected to grow at an impressive rate of nearly 47% per year over the next three years, reflecting strong future potential in high-growth tech sectors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com