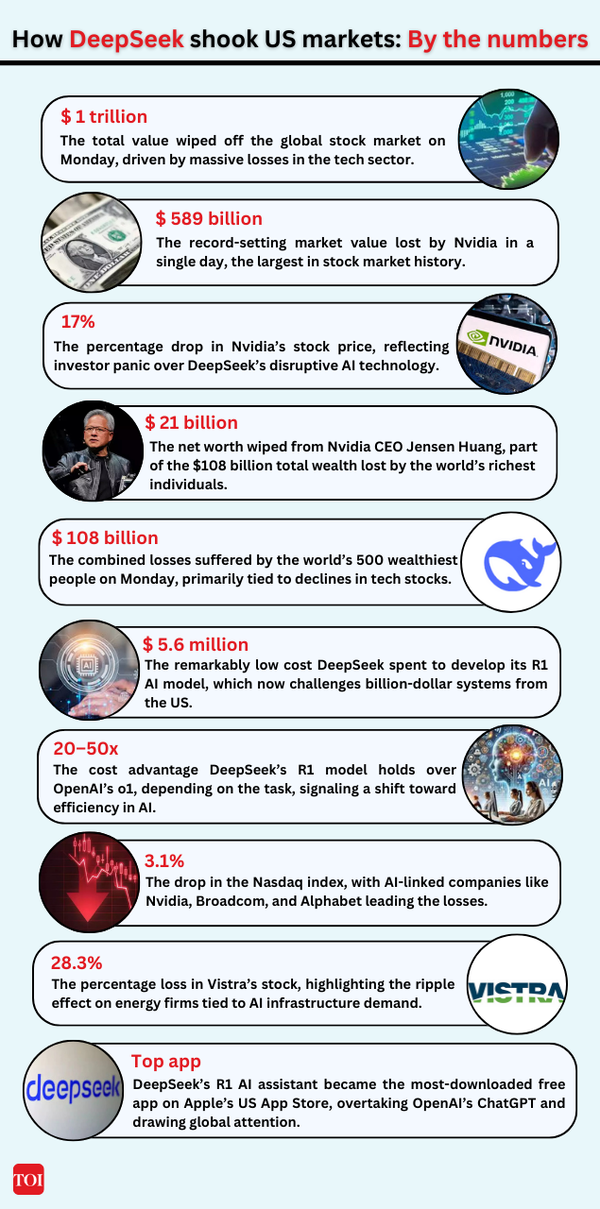

A seismic shift in the global AI landscape rattled stock markets on Monday, as the Chinese startup DeepSeek unveiled a game-changing AI model. The company’s low-cost and high-performing technology sent shockwaves through Wall Street, erasing $1 trillion from the Nasdaq’s market value and sparking fears about the sustainability of the US-dominated AI boom.

Poll

Is DeepSeek’s AI Technology Superior to Other Available AI Tools?

Nvidia, the US chipmaker at the heart of AI infrastructure, suffered the largest one-day market cap loss in history, shedding nearly $600 billion in value. The Nasdaq Composite fell 3.1%, with Google’s parent company Alphabet losing $100 billion and Microsoft dropping $7 billion. The development marks a pivotal moment in the race between the US and China for AI supremacy.

Why it matters

- DeepSeek’s success challenges the prevailing belief that AI dominance depends on massive financial investments and cutting-edge technology. By developing its latest model using Nvidia’s less advanced H800 chips, DeepSeek bypassed US export restrictions and delivered an AI system that rivals offerings from companies like OpenAI and Google at a fraction of the cost.

- This raises critical questions: Is the US strategy of pouring billions into AI infrastructure sustainable?

- Can the multibillion-dollar valuations of US tech companies like Nvidia and Microsoft be justified in light of such efficient alternatives?

- Are US sanctions on China’s access to advanced chips like Nvidia’s H100 truly effective?

- The Nasdaq’s dramatic selloff underscores how vulnerable the market remains to shifts in the AI narrative. As DeepSeek demonstrates, innovation doesn’t always require the most expensive tools.

- The geopolitical implications of DeepSeek’s success are profound. For years, US policymakers have sought to curtail China’s technological ambitions through export controls and sanctions. However, DeepSeek’s rise suggests that these measures may be insufficient to halt China’s progress in AI. By developing competitive models with limited resources, China has signaled its ability to challenge US dominance in a field considered critical to future economic and strategic power.

- Gregory Allen, director of the Wadhwani AI Center at the Center for Strategic and International Studies, pointed out the political significance of DeepSeek’s timing. “The technology innovation is real, but the timing of the release is political in nature,” he said, comparing it to other high-profile Chinese tech launches that coincided with diplomatic tensions.

The big picture: The disruptor from China

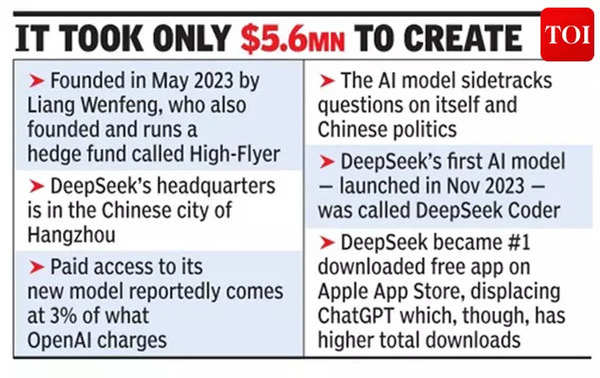

- DeepSeek’s rise has upended conventional wisdom about AI development. Founded in 2023 by Liang Wenfeng, a hedge fund manager, the Hangzhou-based startup leverages bespoke algorithms and open-source principles. The company developed its latest model, R1, for just $5.6 million—a stark contrast to the hundreds of millions that US firms like OpenAI spend to train comparable models.

- DeepSeek’s innovative approach involved using reduced-capability Nvidia H800 chips to train its AI systems. These chips, designed for the Chinese market to comply with US export controls, were thought to be less capable than the H100 chips used by American firms. Despite this limitation, DeepSeek’s R1 model outperformed rivals, including OpenAI’s o1-mini, across several benchmarks.

- Last month, DeepSeek drew significant attention in the AI industry by releasing a new AI model it claimed was comparable to offerings from US firms like OpenAI, the creator of ChatGPT. This model was also touted as more cost-efficient in its use of Nvidia chips to train on massive datasets. The chatbot became more accessible after launching on Apple and Google app stores earlier this year.

- However, the real stir began with a follow-up research paper published last week — coinciding with President Donald Trump’s inauguration anniversary. The paper detailed a new DeepSeek AI model called R1, which demonstrated advanced “reasoning” capabilities, such as rethinking approaches to math problems, and was significantly cheaper than OpenAI’s comparable model, o1.

- “What their economics look like, I have no idea,” Bernstein analyst Stacy Rasgon told AP. “But I think the price points freaked people out.”

- This development calls into question the efficacy of US sanctions designed to curtail China’s progress in AI. If China can achieve such breakthroughs with limited access to advanced technology, the broader implications for US tech dominance and national security are significant.

Trump calls China’s AI DeepSeek breakthrough ‘a wakeup call’ — but ‘positive’ if true

What they are saying

- Prominent voices across tech, politics, and finance have weighed in on the implications of DeepSeek’s success:

- Marc Andreessen, US venture capitalist, likened the development to the Soviet Union’s 1957 launch of Sputnik: “This is AI’s ‘Sputnik moment,’ showcasing how China has narrowed the AI gap faster than expected.”

- Donald Trump, US President, echoed the competitive urgency, stating, “The release of DeepSeek’s AI should be a wake-up call for our industries that we need to be laser-focused on competing to win.” He praised the cost efficiency of DeepSeek’s approach, framing it as a challenge that US companies must rise to meet.

- Liang Wenfeng, DeepSeek CEO, expressed a vision of democratized AI: “AI should be affordable and accessible to everyone.”

Deepseek’s r1 is an impressive model, particularly around what they’re able to deliver for the price. We will obviously deliver much better models and also it’s legit invigorating to have a new competitor! we will pull up some releases.

Sam Altman, CEO of OpenAI

Gone in a day: $1 trillion

- The market reaction to DeepSeek’s announcement was swift and brutal. Nvidia shares plunged 17%, wiping out nearly $600 billion in value. Alphabet lost 4%, and Microsoft dropped 2.1%, highlighting the tech sector’s vulnerability to disruption. The Philadelphia Semiconductor Index fell 9.2%, its steepest drop since the onset of the Covid-19 pandemic.

- The selloff also spilled into global markets: European chipmaker ASML saw a 7% drop.

- In Japan, SoftBank, which has heavily invested in AI, tumbled 8.3%.

- Energy firms like Constellation Energy, banking on AI-driven demand for power, suffered losses of over 20%.

- Richard Hunter of Interactive Investor summed up the market’s anxiety: “It will almost certainly put the cat among the pigeons as investors scramble to assess the potential damage it could have on a burgeoning industry.”

Between the lines

DeepSeek’s success could ignite a price war in the AI market, forcing competitors to reassess their business models. OpenAI, which has heavily invested in costly infrastructure, may face pressure to lower prices—a move that could strain its finances further.

Some analysts, however, remain skeptical about DeepSeek’s claims. Stacy Rasgon of Bernstein noted, “While DeepSeek’s pricing blows away the competition, the notion that they achieved this for $5.6 million seems overly optimistic. Hidden costs likely exist.”

Nevertheless, DeepSeek’s open-source approach has earned praise for its potential to democratize AI access. Dr.Andrew Duncan of the UK’s Alan Turing Institute remarked, “It demonstrates that you can do amazing things with relatively small models and resources.”

What’s next

The emergence of DeepSeek comes at a critical time for US tech giants, with companies like Apple and Microsoft set to report earnings this week. Investors will be watching closely for signs of how these firms plan to navigate a more competitive AI landscape.

At the same time, the broader geopolitical implications are profound. DeepSeek’s rise highlights the diminishing returns of US export controls. If China can produce world-class AI models without access to advanced hardware, the US may need to rethink its approach to maintaining technological leadership.

Trump has already signaled his administration’s intent to tighten restrictions further, calling for the elimination of loopholes in existing export controls. However, some experts, like Gregory Allen of the Center for Strategic and International Studies, believe the timing of DeepSeek’s announcement may have been politically motivated to undermine US policies.

(With inputs from agencies)