Also in the letter:

■ Tata Digital’s new Esop plan

■ Uber’s premium play

■ Fresher pay at IT firms in spotlight

Temasek in talks for up to $150-million bite of Rebel Foods

Rebel Foods founders Kallol Banerjee (left) and Jaydeep Barman

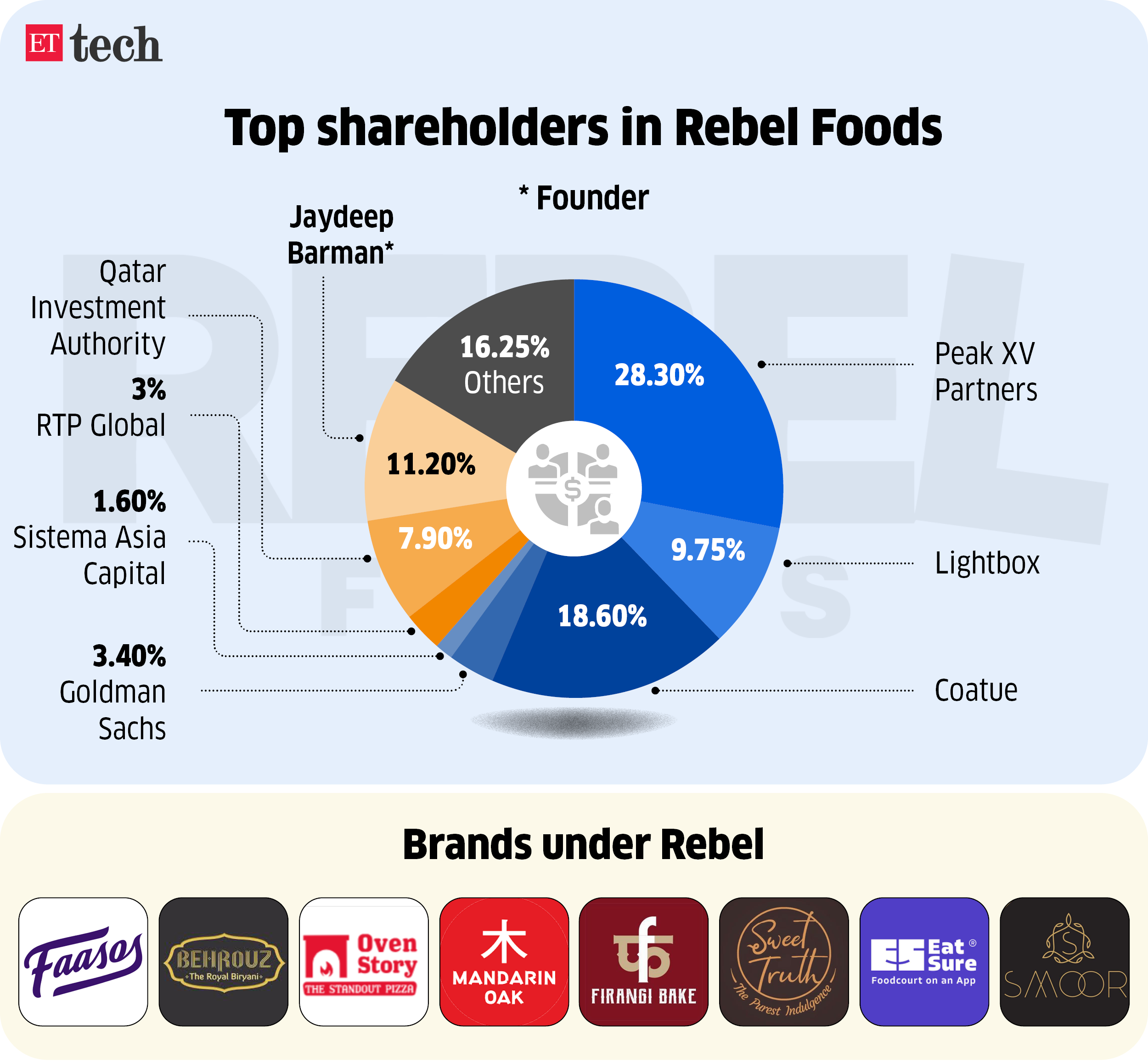

Temasek, Singapore’s sovereign wealth fund, is in advanced talks to lead a $100-150 million investment in Rebel Foods, the parent company of brands such as Faasos and Behrouz Biryani, sources told us.

Deal details: The proposed deal will be a mix of primary and secondary share sales. Existing shareholders US-based Coatue and homegrown fund Lightbox are expected to part-sell stakes in the secondary transaction – wherein money doesn’t go to company coffers, unlike in primary funding.

“Coatue and Lightbox are finalising the quantum of secondaries, and other investors may also join in that. Temasek is joining as a new investor,” one person cited above said.

Valuation maths: Sources said the fundraise is likely to happen at nearly the same valuation as its last round of fundraising in October 2021, when it was valued at $1.4 billion. Meanwhile, the secondary deal is likely to take place at a lower valuation of around $700 million.

Zoom in: The Mumbai-based company recently announced plans to go public in the next one to two years. Oven Story Pizza, Mandarin Oak, Firangi Bake, and Sweet Truth are among its brands. Eat Sure is its own platform for ordering from all these brands, under which it runs offline outlets as well.

Also Read | Temasek planning to invest $10 bn in India over 3 yrs amid China slump

Big picture: This comes at a time when cloud kitchen brands have seen moderate growth and are enhancing their online presence. The investment in Rebel Foods is also part of a series of big-ticket late-stage deals making a comeback, which ET has been reporting on. Early-stage food and beverages brands are also attracting investor attention.

Also Read | VCs crowd deal street on quick commerce, D2C success

Gig worker demand set to rise 40% during festive season peak

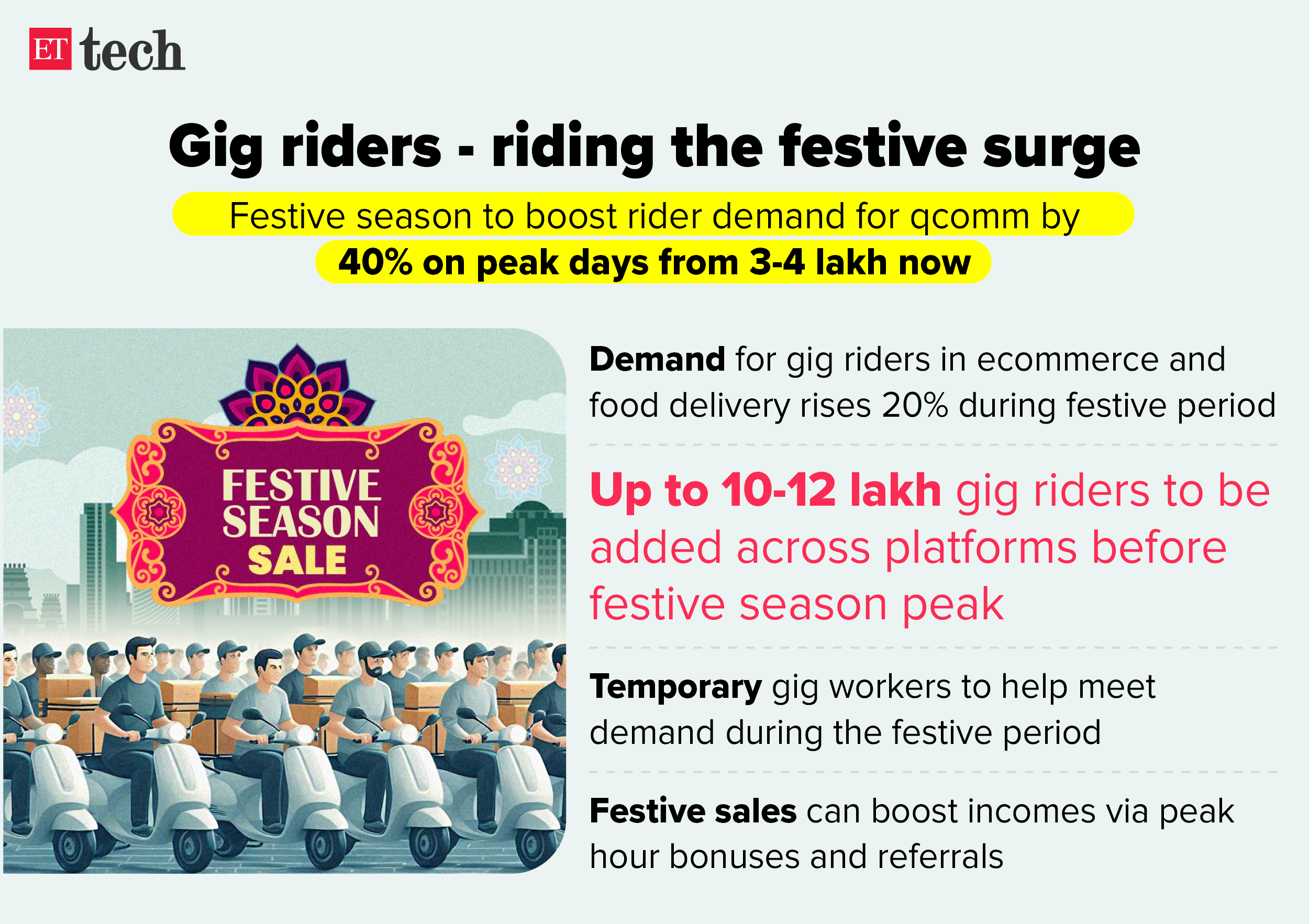

As the festive season kicks in, the demand for gig work riders employed by quick commerce platforms may grow by as much as 40% on peak demand days from the current level of about three to four lakh riders, industry executives told ET.

Growing share: There will be an addition of up to 10-12 lakh gig riders across all platforms in the ramp up to the festive season peak. Though quick commerce still represents a small share of overall demand, that share is rapidly increasing, said Balasubramanian Anantha Narayanan from TeamLease. Part of the demand will be met by temporary gig workers during the festive period.

Rider incentives: Festive sales can help delivery workers bump up their incomes, both through peak hour bonuses and referrals for new joinees. However, unlocking such benefits can take “unrealistic and backbreaking” 12-14 hour shifts, the delivery workers said.

Better benefits: Platforms need to provide workers with minimum business guarantees, higher rates, and other benefits, Shaik Salauddin, president of the Indian Federation of App-Based Transport Workers, said. “When everyone is home with their family during the festive season, the delivery worker is out there on the roads. The platforms should provide better benefits during this period,” he added.

Also Read | Festive season begins with a bang: quick commerce sees jump in sales

Tata Digital rolls out Esops for its senior execs to push performance

Naveen Tahilyani, CEO, Tata Digital

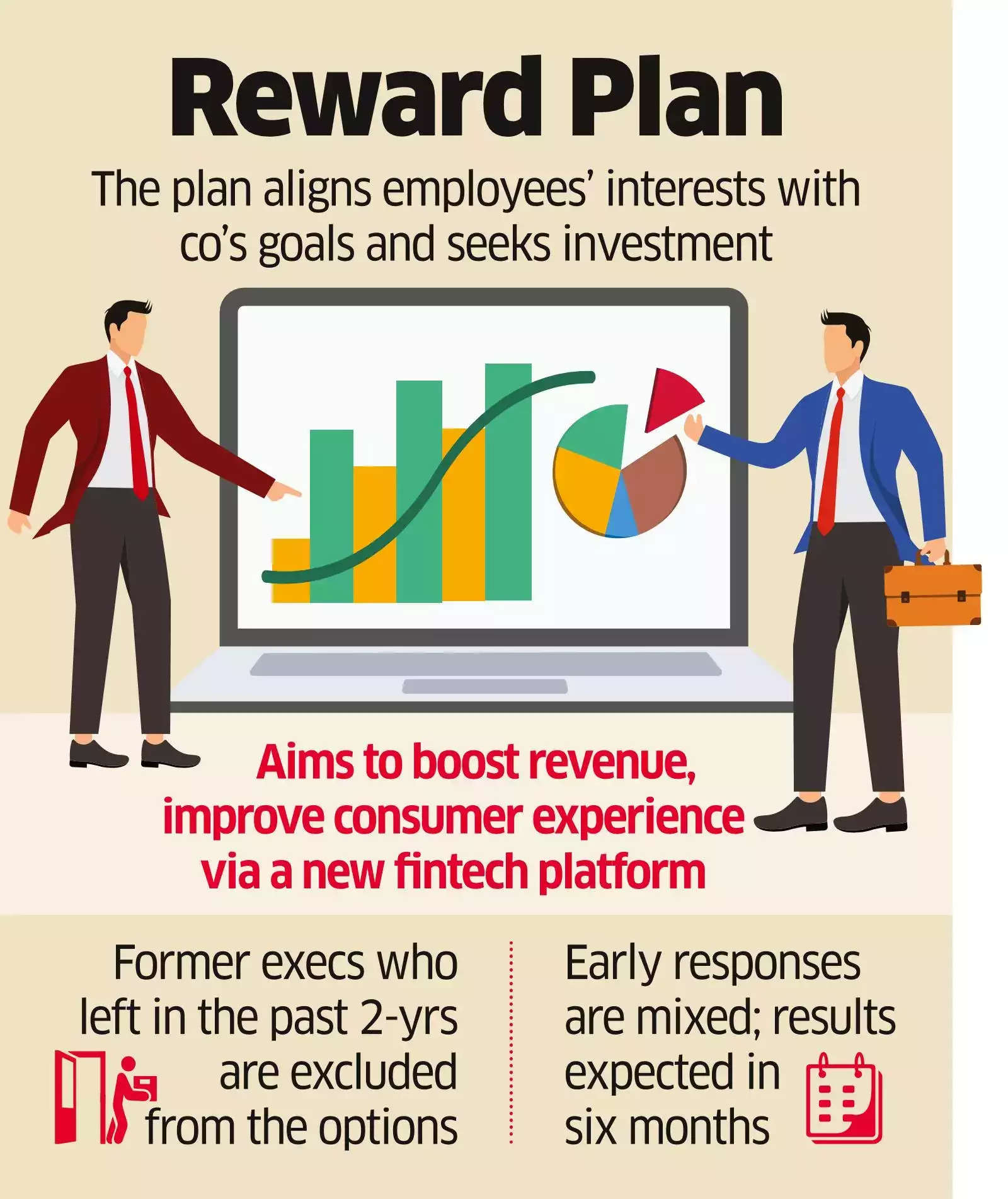

Tata Digital has launched a new employee stock option plan (Esop) for the top deck under chief executive Naveen Tahilyani amid significant turnover in the company’s senior leadership.

Driving the news: The proposal was approved during the recent annual general meeting of Tata Digital, the ecommerce arm of the conglomerate that operates the Tata Neu superapp and owns online grocer Big Basket and epharmacy 1mg.

It is following new-age companies like Flipkart and Razorpay that employ Esops as a retention tool and a wealth-creating method for employees.

Big picture: Tahilyani, who took helm in February this year, has been revamping the top deck, leading to several exits. With these Esops, he looks to enforce a performance-oriented culture at the firm and a strict accountability system with no tolerance for missed deliverables. Employees’ response to the plan has so far been mixed, people in the know said.

Structural woes: Tata Digital is yet to establish a uniform management structure as it grapples with the challenges of merging BigBasket and 1mg. Currently, both entities retain their startup culture and continue to function independently. Tahilyani has held meetings with the chief executives of both companies to sort out the issue.

Also Read | Tata funds pause is no ‘debt-errent’ at 1mg, BigBasket

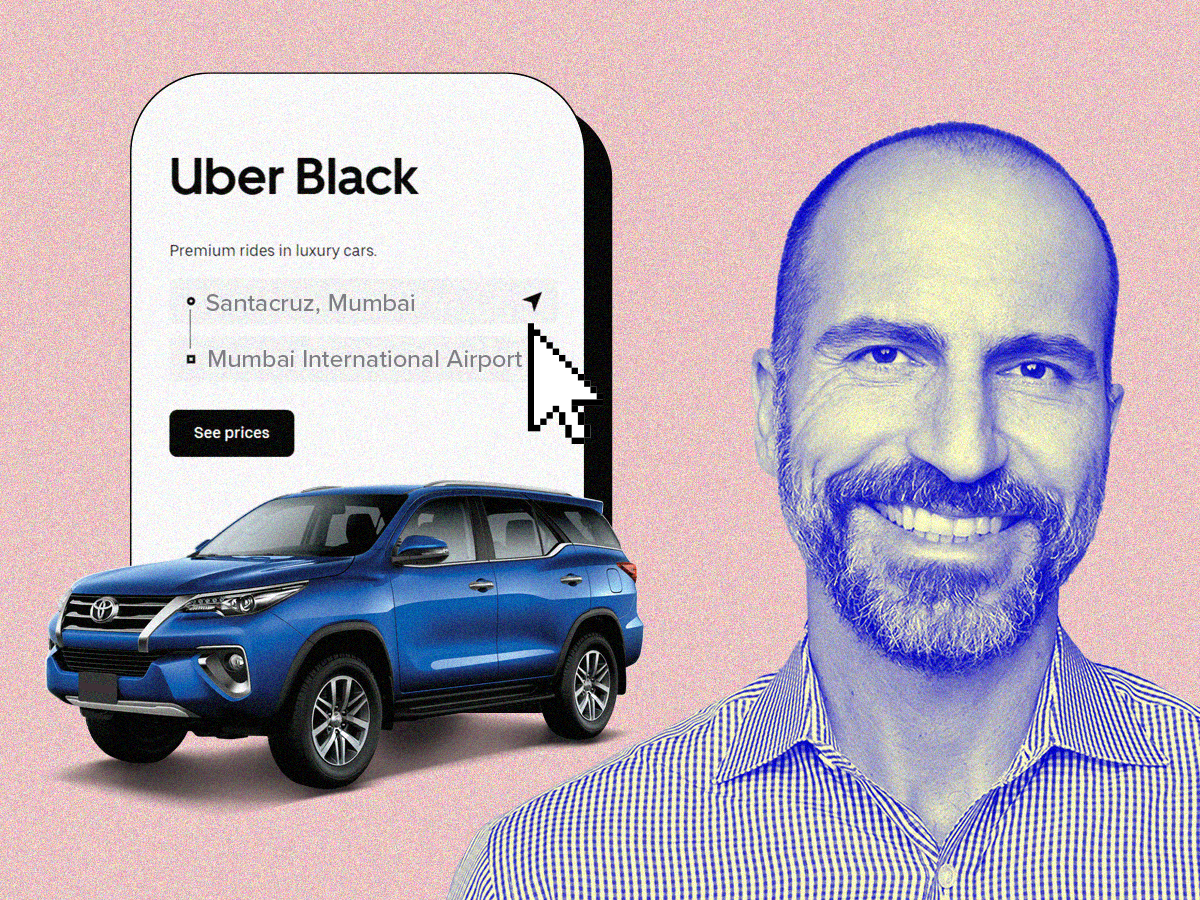

Uber to bring ‘Black’ back in big premiumisation push

Uber is set to relaunch its luxury ride-hailing service, Uber Black, in India as part of its strategy to enhance its premium offerings, according to sources.

U-turn: The company had started its India operations in 2013 with the Uber Black service, under which luxury cars like Mercedes, BMW, and Audi were available on demand. These were later replaced with the likes of Toyota Innova, Honda City, and Toyota Corolla. Black was discontinued a year later.

However, one of the sources cited earlier said the revamped version of Uber Black will be a “far more sustainable model”.

Also Read | Upstarts are everywhere, we have to be constantly on our toes in India: Uber CEO Dara Khosrowshahi

What else: Uber Black will be priced 30-40% higher than the platform’s existing top product, Uber Premier, and the company expects it to have “huge traction with corporate travel use cases”.

This is a step towards Uber’s goal of being a mobility app that caters to all groups of customers. With cab aggregators like Uber and Ola struggling to maintain reliability and quality of service on their basic offerings, there is a scope of entry for premium cab operators.

Also Read | Uber ups hyperlocal deliveries as quick commerce takes off

Other Top Stories By Our Reporters

A fresh start: how outsourcing firms are attracting skilled freshers with higher pay packets | The issue of starting salaries for freshers at IT firms was in the spotlight recently when Cognizant made headlines for offering a salary of Rs 2.5 lakh, although it was later clarified that this was for a non-engineering graduate. At the same time, however, top IT firms like TCS, Cognizant, and Infosys are rolling out specialised hiring programs that offer significantly higher salaries (up to triple the average) for skilled engineers.

MS Dhoni, Sachin Tendulkar, Virat Kohli, other cricketers start up a different game: Cricketers, both past and present, are making equity investments or even turning founders of various new ventures, joining a growing cohort of celebrities looking beyond traditional endorsements.

Automakers’ tech alliances threaten IT’s ER&D bastion: At a time when rising insourcing is impacting information technology firms, tech alliances among automobile companies are causing another threat to the Indian IT ER&D (engineering research and development) business.

Global Picks We Are Reading

■ Move over, text: Video is the new medium of our lives (MIT Technology Review)

■ Teens are making thousands by debating Trump vs. Harris on TikTok (Rest of World)

■ Stephen Wolfram thinks we need philosophers working on big questions around AI (TechCrunch)