Reinsurance giant’s Munich Re and Swiss Re remain the two largest global reinsurers across the globe according to data from ratings agency AM Best.

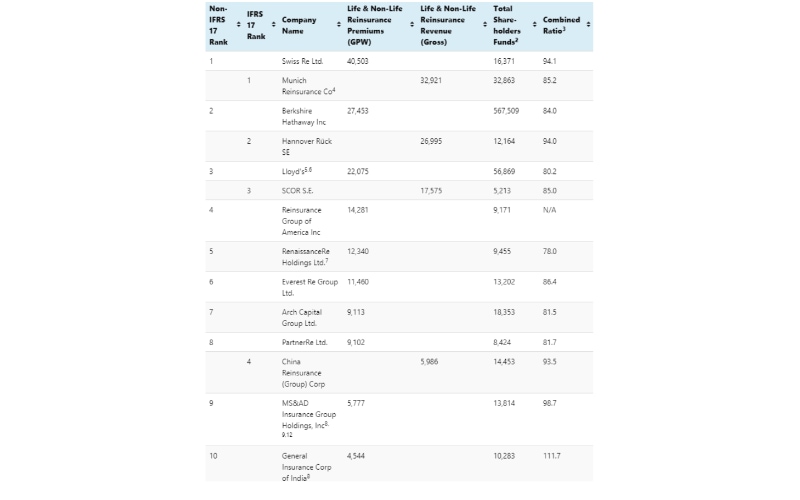

In prior years, the agency ranked the top 50 global reinsurers in a single list, but now, with the adoption of IFRS 17, the agency’s approach has now changed. Therefore, companies that report under IFRS 17 are ranked 1-15 based on gross reinsurance revenue, while companies that report under non-IFRS 17 are ranked 1-35 based on gross written reinsurance premium (GWP)

Both Munich Re and Swiss Re remain the largest global reinsurers, but they are using different accounting standards this year, however this will change once Swiss Re adopts IFRS 17.

In terms of gross reinsurance revenue, Munich Re posted $32.9 billion, as well as a non-life combined ratio of 85.2% in 2023.

Munich Re’s growth in reinsurance revenue, is mainly attributable to P&C reinsurance, which was driven by the expansion of existing business, but countered in part by negative currency translation effects.

As for Swiss Re – which took the top spot among non-IFRS 17 reporting companies – the reinsurer posted $40.5 billion in GWP in 2023.

Hannover Re came in second place under companies that report under IFRS 17, while Berkshire Hathaway came in second place among non-IFRS 17, respectively.

Hannover Re reported $27.0 billion in gross reinsurance revenue and posted a non-life combined ratio of 94% in 2023, while Berkshire Hathaway posted $27.4 billion in GWP in 2023.

French reinsurer SCOR came in third place, reporting under IFRS 17, securing $17.5 billion in gross reinsurance revenue in 2023, while Lloyd’s sat in third place under non-IFRS 17, seeing premium growth of 19.1%, from $18.5 billion to $22.1 billion in 2023.

Reinsurance Group of America (RGA) and RenaissanceRe came in fourth and fifth place for non-IFRS 17 reporting, respectively, with RGA posting $14.3 billion in GWP and RenaissanceRe posting $12.3 billion in GWP.

Everest Re took the sixth spot, moving up four places from last year, securing $11.5 billion in GWP in 2023, while Arch Capital Group, came in seventh place, compared to its spot in fourteenth last year, posting $9.1 billion in GWP.

PartnerRe, MS&AD Insurance Group Holdings, and General Insurance Corporation of India closed out the top 10 for non-IFRS 17, coming in at eighth, ninth and tenth place, respectively.

PartnerRe posted $9.1 billion in GWP in 2023, with MS&AD posting $5.8 billion, along with General Insurance Corporation of India reporting $4.5 billion.

Going back to companies reporting under IFRS 17, China Re came in fourth place with $6.0 billion in gross reinsurance revenue in 2023, while Italy-headquartered insurer Generali, shifted to fifth place with $4.2 billion in gross reinsurance revenue.

Korean Reinsurance Company jumped up to sixth place, posting $4.0 billion in gross reinsurance revenue in 2023, while Canada Life Re moved down to seventh place – after sitting in fourth place last year – with $3.5 billion in gross reinsurance revenue in 2023.

Sompo International Holdings, AXA XL and Peak Reinsurance (Peak Re) closed out the top 10 reporting under IFRS 17, coming in eighth, ninth and tenth place, respectively.

Sompo Intl. posted $3.0 billion in gross reinsurance revenue in 2023, while AXA XL, closely behind, posted $2.8 billion.

And lastly, Hong Kong-domiciled reinsurer, Peak Re, posted $1.5 billion in gross reinsurance revenue in 2023.