As global markets experience fluctuations, with U.S. consumer confidence declining and major stock indexes showing moderate gains in a holiday-shortened week, investors are closely watching the tech sector’s performance amidst shifting economic indicators. In this environment, identifying high-growth tech stocks with robust fundamentals and potential for innovation can be crucial for navigating market volatility and capitalizing on emerging opportunities.

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1263 stocks from our High Growth Tech and AI Stocks screener.

We’re going to check out a few of the best picks from our screener tool.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Gstarsoft Co., Ltd. focuses on the research, development, design, and sale of industrial software both in China and internationally, with a market capitalization of CN¥2.49 billion.

Operations: Gstarsoft generates revenue primarily from the sale of industrial software solutions, catering to both domestic and international markets. The company invests significantly in research and development to enhance its product offerings.

Gstarsoft’s recent financial performance reveals a nuanced picture, with revenue slightly increasing to CNY 197.77 million from CNY 194.34 million year-over-year, yet net income has decreased to CNY 34.69 million from CNY 42.28 million, reflecting challenges despite top-line growth. The company’s R&D focus is critical in maintaining its competitive edge in the software industry, where innovation drives success; however, specific R&D expenditure figures are crucial for evaluating its commitment to innovation compared to industry peers. Looking forward, Gstarsoft’s projected annual earnings growth of 24.2% and revenue growth rate of 24% outpace the broader Chinese market forecasts of 25.2% and 13.6%, respectively, suggesting robust potential despite current profitability pressures evidenced by a decline in profit margins from last year’s 23.8% to this year’s 16.5%. This backdrop of high anticipated growth coupled with recent buyback stagnation—no shares repurchased recently—paints a complex but potentially promising future if strategic focuses align effectively with market demands and investment in innovation continues aggressively.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Insyde Software Corp. offers system firmware and software engineering services globally for mobile, desktop, server, and embedded systems industries with a market cap of NT$17.46 billion.

Operations: The company generates revenue primarily from its software and programming segment, amounting to NT$1.56 billion. It operates in the mobile, desktop, server, and embedded systems industries worldwide.

Insyde Software’s recent earnings report showcases a robust growth trajectory, with third-quarter sales climbing to TWD 413.37 million from TWD 356.96 million year-over-year and net income rising to TWD 88.49 million from TWD 68.54 million, reflecting a solid uptick in profitability. This performance is underpinned by significant R&D commitments, crucial for maintaining its competitive edge in the rapidly evolving software sector; notably, the company’s annualized earnings growth at an impressive rate of 59.9% outstrips broader market expectations. Additionally, the strategic appointment of a new CTO could signal a further intensification of their innovation efforts, potentially driving future revenue streams and reinforcing their position in high-growth tech markets despite prevalent share price volatility.

Simply Wall St Growth Rating: ★★★★☆☆

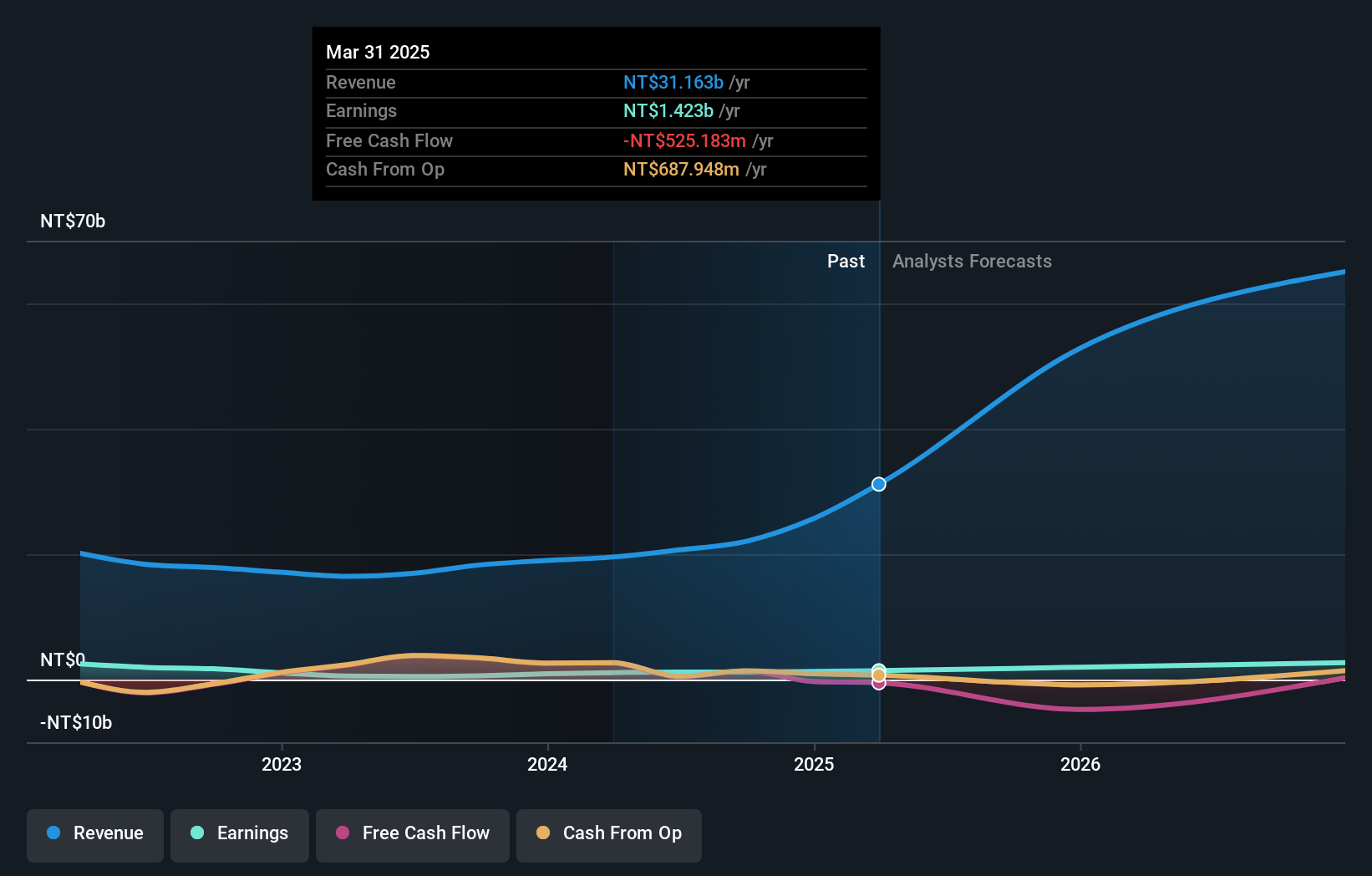

Overview: ASROCK Incorporation is a Taiwanese company that designs, develops, and sells motherboards, with a market capitalization of NT$28.61 billion.

Operations: The company’s primary revenue stream comes from the sale of motherboards, generating NT$22.05 billion.

ASROCK Incorporation’s recent financial performance underscores its resilience in a competitive tech landscape, with third-quarter sales surging to TWD 6.27 billion, up from TWD 4.90 billion year-over-year. This growth is complemented by a robust annualized revenue increase of 22.8%, signaling strong market demand for their products. Despite slight fluctuations, net income remained stable at around TWD 305 million. The company’s strategic board reshuffles and establishment of new committees reflect a proactive approach to governance and innovation, positioning ASROCK to capitalize on future tech trends and maintain its momentum in the evolving industry landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com