New research from Deloitte suggests that nine of Europe’s richest football clubs now hail from the English top-flight. But even as the Premier League hopes to increase this with a possible fifth Champions League berth next season, the additional workload could cause a situation in which players strike – threatening the reputation and revenues of football’s top table.

Now in its 28th edition, the Deloitte Football Money League profiles the highest revenue generating football clubs in world football. According to the study, the 2023/24 season unlocked a new frontier, as Real Madrid became the first football club to record €1 billion in revenue – on the way to its seemingly inevitable 15th Champions League title – while the newly renovated Bernabéu Stadium delivered significant uplifts to matchday and commercial revenue over the previous season.

While the Spanish giants topped the list, however, only two other clubs from La Liga featured in the top 20 – Barcelona and Atletico Madrid. In contrast, the Premier League continued to dominate the ranking in terms of the volume of entries – with a total of nine representatives. Alongside second-placed Manchester City, who raked in €837 million over the season, Manchester United, Arsenal, Liverpool, Tottenham Hotspur and Chelsea all ranked in the top 10 – bringing in more than €545 million each. Meanwhile, European adventures for Newcastle United, West Ham United and Aston Villa added three more English clubs to the top 20, with incomes of more than €300 million each.

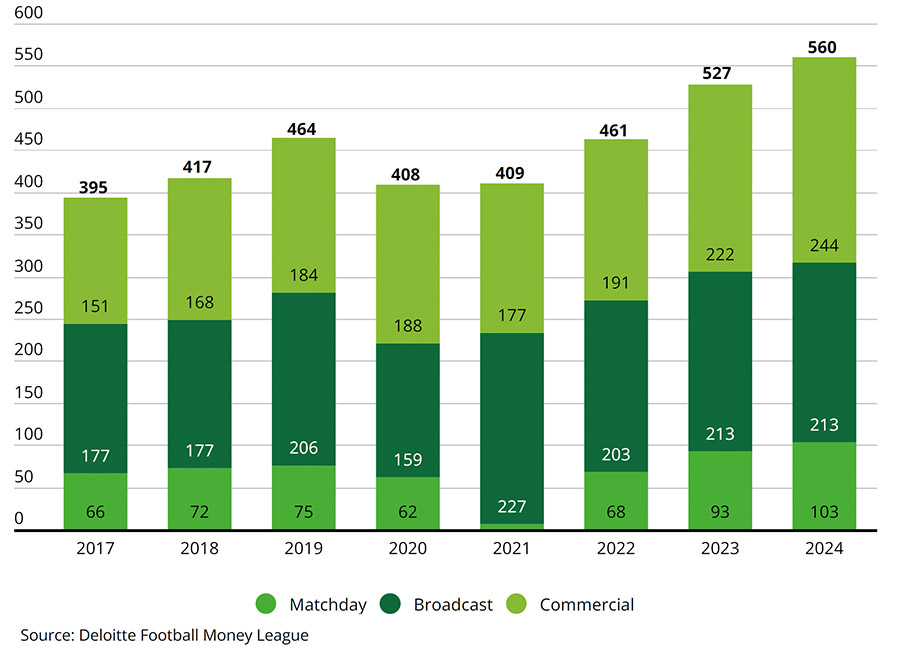

Overall, revenues across Deloitte’s top 20 enjoyed a bumper year in general – with the lean 2020 and 2021 seasons now a distant memory. Having seen average matchday, broadcast, and commercial revenues sink to around €409 million then, they now top €560 million per club – and in the coming seasons, that may even rise further, thanks to a the revamped formats of Europe’s three continental competitions for men’s clubs.

And after the expansion of UEFA’s Champions League this year, Deloitte notes that more material uplifts could come from an increase in the number of matches played by clubs via the introduction of new formats to existing competitions. This can be expected on account of changes made to UEFA club competitions from 2024/25, and the expanded FIFA Club World Cup between June and July 2025.

For example, per Deloitte analysis, excluding the impact of changes to the number of pre-knock out matches, winning the Champions League could result in revenue uplifts of €15 million over the previous format. Similarly, the FIFA Club World Cup is expected to provide a significant uplift to some non-European clubs such as Flamengo, who this year ranked in the top 30 of the Money League for the first time since 1996/97 and Inter Miami.

However, the researchers also note there is a need to balance revenue optimisation with player welfare as many stakeholders acknowledge the impact of increased workloads. Clubs such as Real Madrid, Manchester City and Flamengo who are participating in the FIFA Club World Cup in 2025 could have potentially played in 68, 74, and 87 matches respectively during the 2024/25 season – and in October 2024, this led FIFPro Europe to file a formal complaint to the European Union over the international match calendar.

If those challenges are not be resolved, Deloitte contends that “there exists a financial risk if the union votes to implement a strike during the football season”. Trying to quell this rather than addressing it could also be counterintuitive, as overworking top athletes will ultimately reduce their on-pitch performance, and the entertainment that fans, broadcasters, sponsors, and investors all desire from the product.

“The inability to resolve this key challenge will damage the value of the sport in all senses in the long-term,” the researchers conclude.