The valuation conundrum

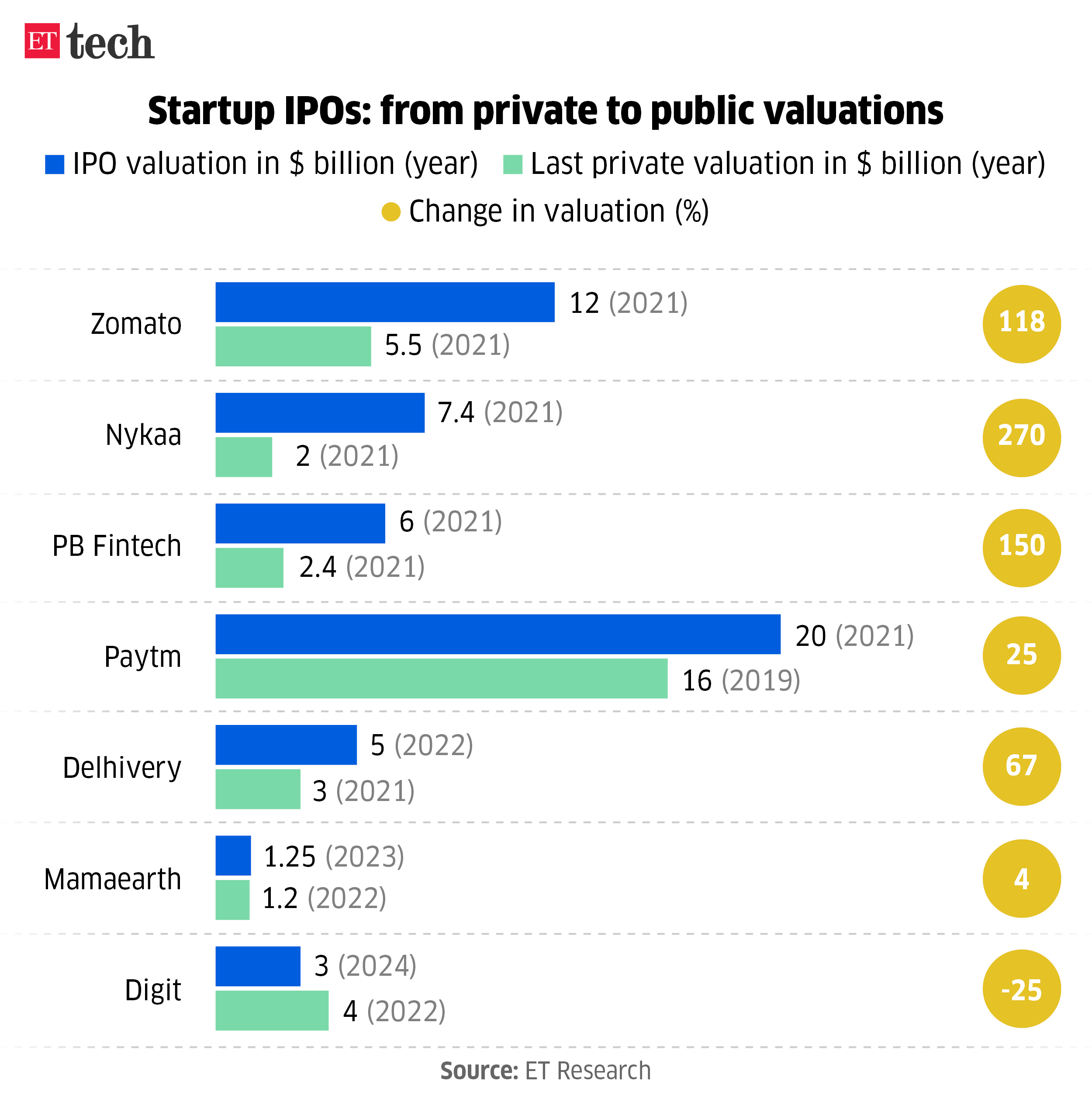

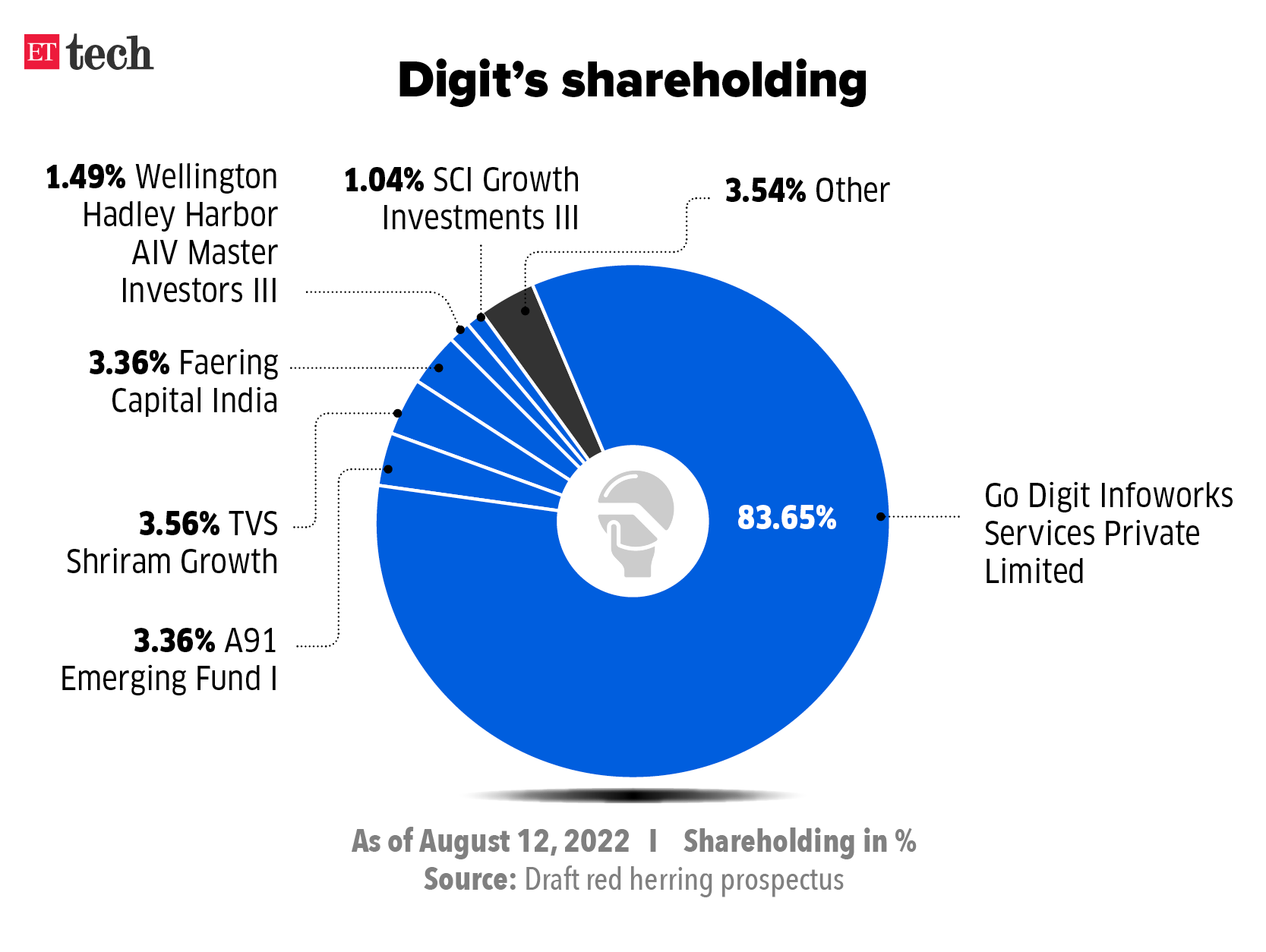

At a price band of Rs 258 to Rs 272, Digit is looking to value itself at $3 billion through the IPO when it lists. According to regulatory filings accessed through data platform Tracxn, in 2022 Digit had picked up $54 million from Peak XV Partners, formerly Sequoia Capital India, which valued it at $4 billion. In 2021, the insurance firm was in talks to raise $200 million, but only managed to shore up around $140 million.

Kamesh Goyal, chairman, Digit Insurance

Speaking at a pre-IPO media briefing in Mumbai, Digit chairman Kamesh Goyal said the price band was based on the assessment made by investment bankers and that the company was leaving value on the table for public investors. The development underscores how Indian startups are coming to terms with the valuation reset across the tech world with the end of the Zero interest-rate policy (ZIRP) era.

By the numbers: Overall, it is a smaller IPO. In terms of fresh funding, the company is raising Rs 1,125 crore compared to the initial plan of Rs 1,250 crore, while the offer for sale from existing shareholders has also been reduced to 54 million shares compared to the initial plan of 109.4 million shares.

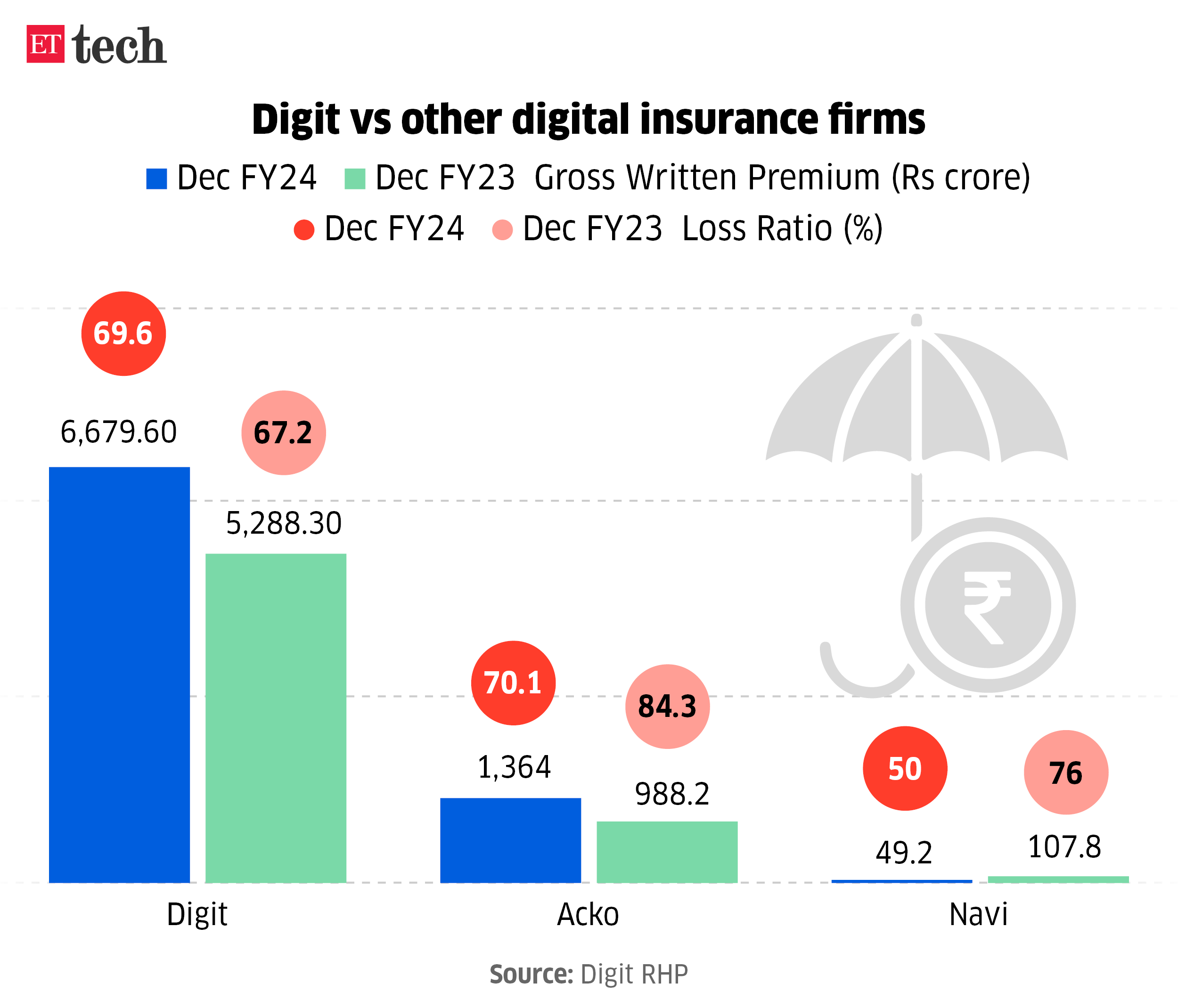

At Rs 272, the higher end of the price band, Digit is seeking a multiple of 680 times, compared to an industry average of 46.13 times. The question is: given the dependence of the business on a physical distribution network, will this valuation hold over the next few years, or will Digit get valued closer to the likes of ICICI Lombard General Insurance?

Digit has built a network of more than 61,000 key distribution partners with around 58,532 physical point of sales agents. Going forward Digit expects the majority of its customers to be acquired through its agent and broker network, the company said in its prospectus.

“If Digit is seeking the valuation multiples of a tech startup, then it needs to build more of a tech-based direct business which will keep costs under check and allow it to innovate on customer engagement. Currently, it is very similar to other traditional insurers,” said a founder of an insurtech startup who tracks Digit closely.

Digit’s competitor Acko has raised $489 million in equity funding achieving a unicorn valuation as of 2022.

Also read | Virat Kohli, Anushka Sharma to score 263% return, Rs 7 crore profit with Go Digit IPO

Business model

Currently, motor insurance makes up 61% of Digit’s business in a highly competitive market. Health insurance, which is a stickier product with better margins, contributes around 14% of the gross premium.

While the health business has grown, in terms of the share of the overall health insurance market, Digit is still at around 3%.

Overall, Digit will have to up its game across multiple insurance products to continue the premium growth which will justify its valuation multiples.

In a research report published by Muddy Waters on February 8, the US investment firm noted that Digit was able to push up its valuation because of lack of investment discipline among Silicon Valley funds in 2021. “Unfortunately for Digit, due to the Indian regulatory process, it was unable to list while the market was still hot…. This will likely lead to a down round IPO,” the report said.

As things stand, Digit is set to go public at a very crucial time — when there’s a correction taking place in the private valuations of the entire tech industry. In these times, for a new-generation insurance company to go public will make two things clear: the real potential of the Indian insurtech sector, and the actual appetite of Indian retail traders.

Fintech news

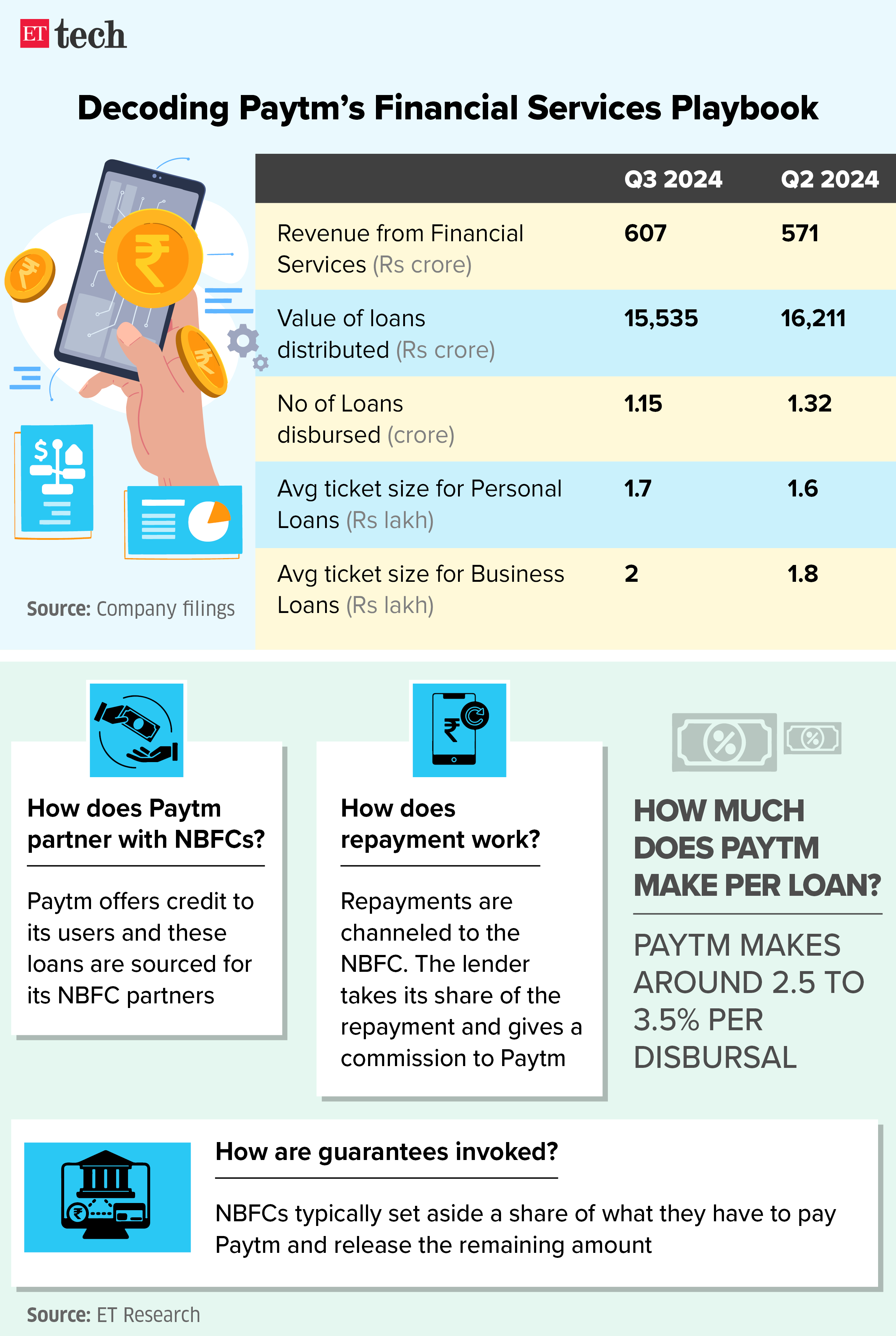

Aditya Birla Finance, others may have invoked Paytm’s loan guarantees | Aditya Birla Finance, one of the key lending partners for One 97 Communications-owned Paytm, is learnt to have invoked loan guarantees which the fintech firm had provided to the lender in lieu of repayment defaults from customers, people in the know of the matter told ET.

Paytm Payments Bank moves bill pay business to Euronet India: Paytm Payments Bank (PPBL) has migrated its bill payment business to Euronet Services India, said two people in the know. This comes after the shifting of PPBL’s retail point of sales business to RBL Bank and the settlement business for merchant payments to Axis Bank.

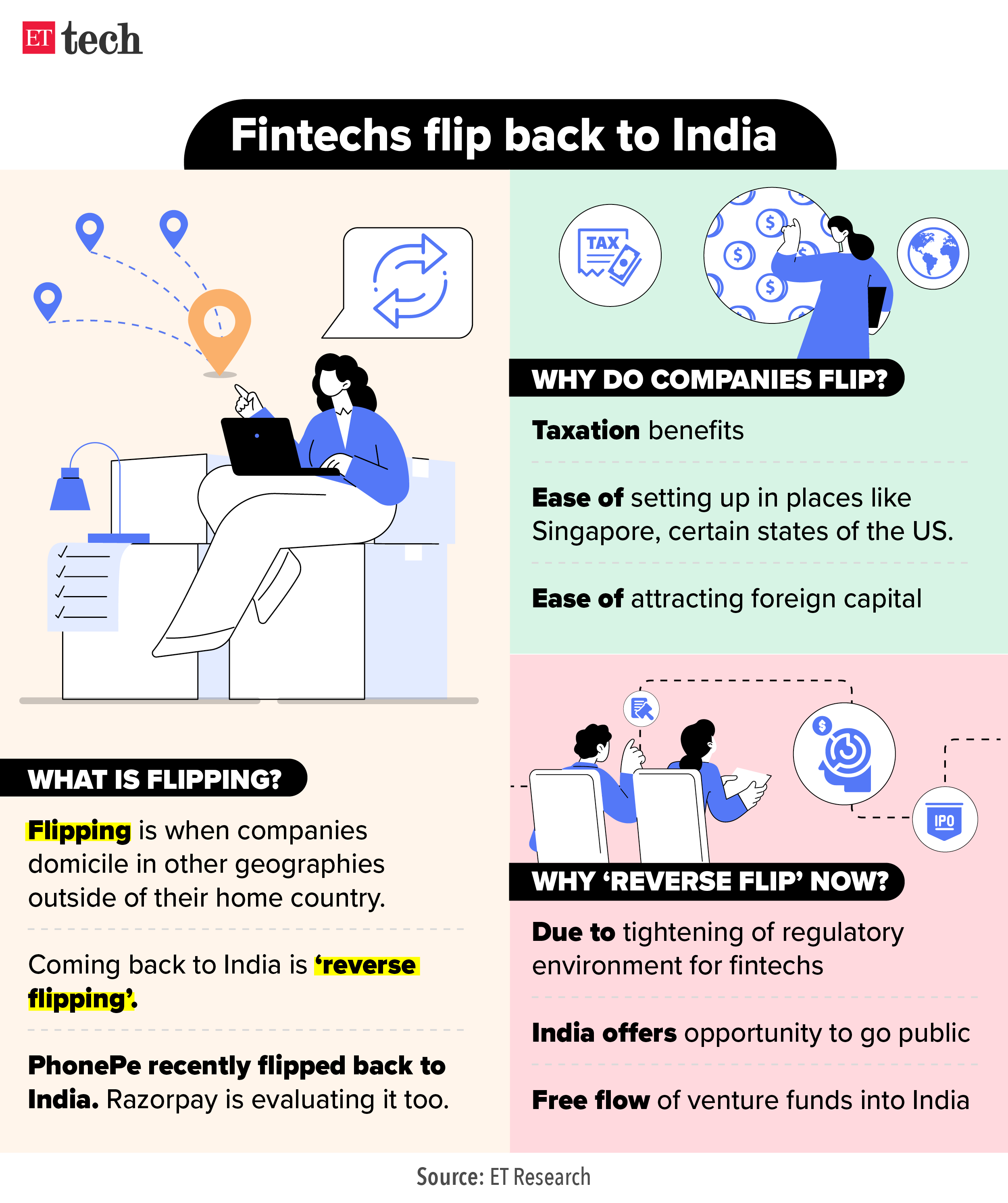

Groww moves domicile to India from the US: Wealth management startup Groww has moved its domicile to India from the US, following a trend of ‘reverse-flipping’ by Indian startups seeking to capitalise on a maturing startup ecosystem in the country.

Digital fraud-hit banks turn to startups to cope with risks: A massive rise in attacks on the country’s digital banking ecosystem from fraudsters, coupled with regulatory pressure on stringent implementation of customer verification guidelines, has forced legacy financial institutions to turn to data analytics startups for tech support.

ETtech exclusives

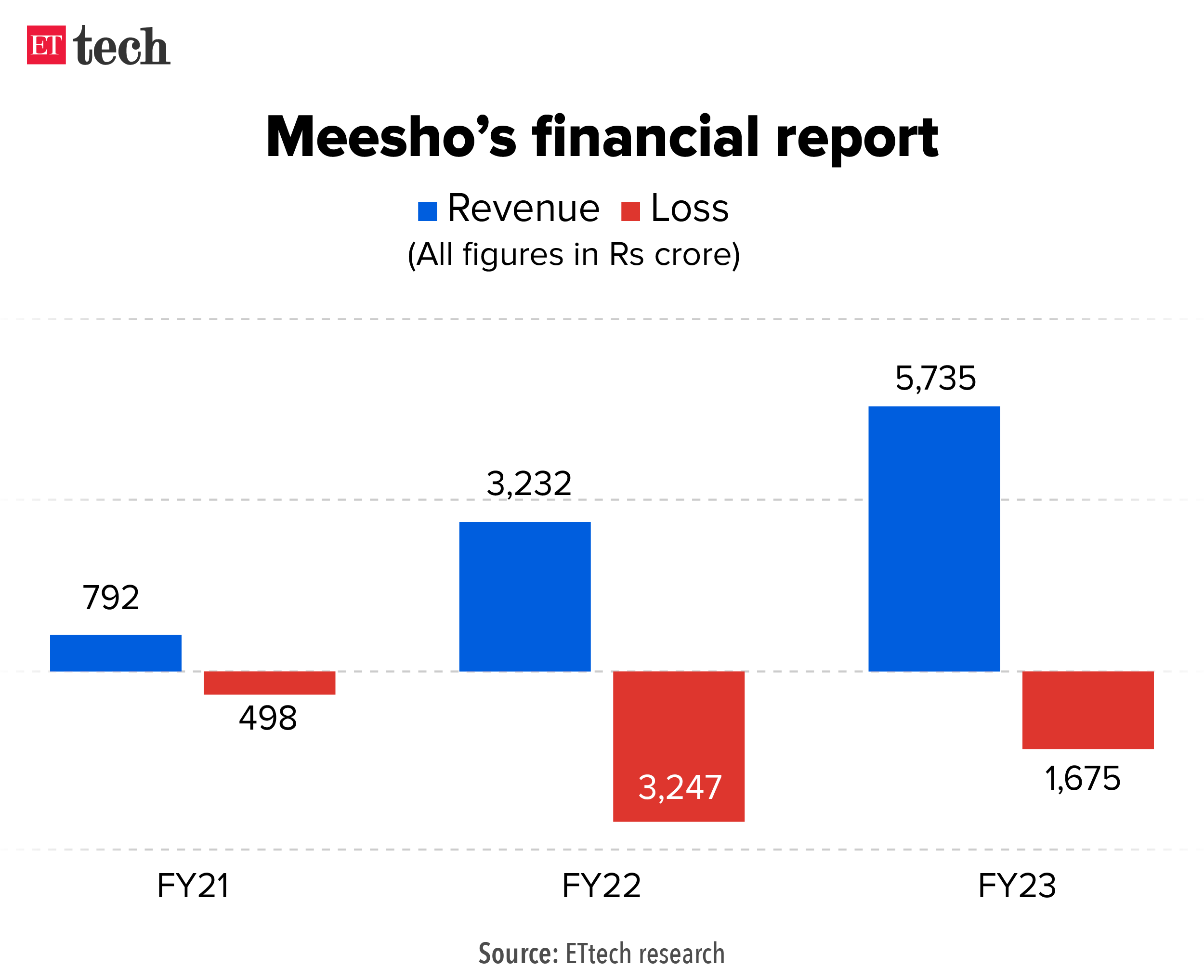

Vidit Aatrey, CEO, Meesho

Meesho closes $275 million funding in first tranche, in talks for more: Ecommerce firm Meesho has closed a $275 million funding round through a mix of primary and secondary share sales, two people aware of the matter said. A regulatory filing with the US Securities and Exchange Commission (SEC) also indicated share transfer at Meesho’s US parent firm without offering further details.

SoftBank back at deal counter with Icertis deal talks: SoftBank, one of the largest technology investors, has begun early-stage talks to double down on existing software portfolio firm Icertis, which is stitching up a new funding round of about $150 million (about Rs 1,252 crore), in a secondary share sale, said people familiar with the development.

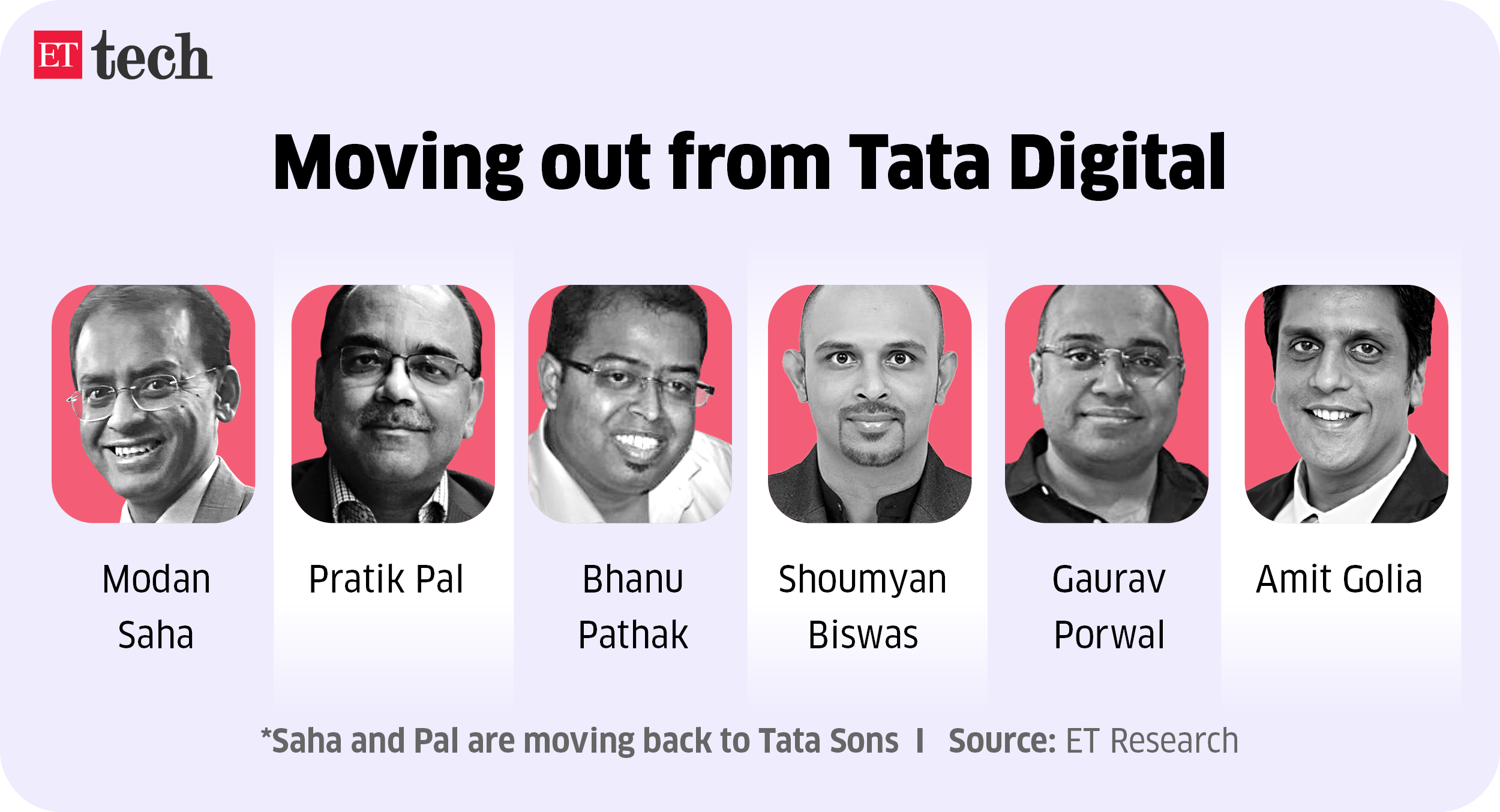

Old guard is out as Tata Digital’s new CEO revamps deck: Tata Digital is witnessing an organisational rehaul in its senior management under new chief executive Naveen Tahilyani, with several exits from the old crop that launched the Tata Neu superapp two years ago, people aware of the matter said.

Uber ups hyperlocal deliveries as quick commerce takes off: Ride-hailing platform Uber is strengthening its hyperlocal deliveries from neighbourhood stores, people aware of the matter said, amid growing demand for quick commerce in India.

Other top stories this week

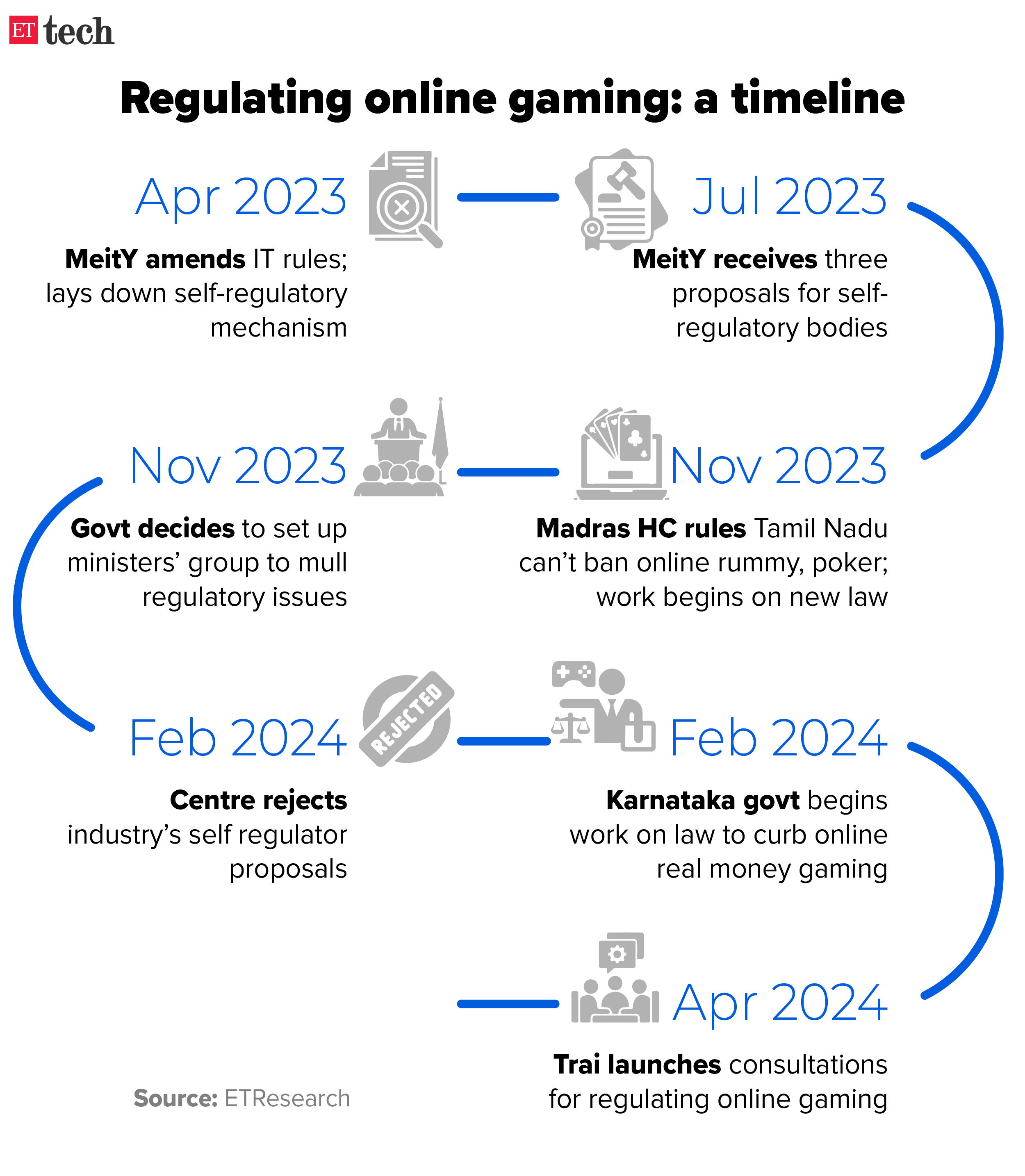

States, Trai jump into the fray to regulate online gaming | In the absence of a self-regulatory mechanism for online gaming, multiple regulatory offshoots are emerging for the sector. These include laws being framed by states including Tamil Nadu and Karnataka.

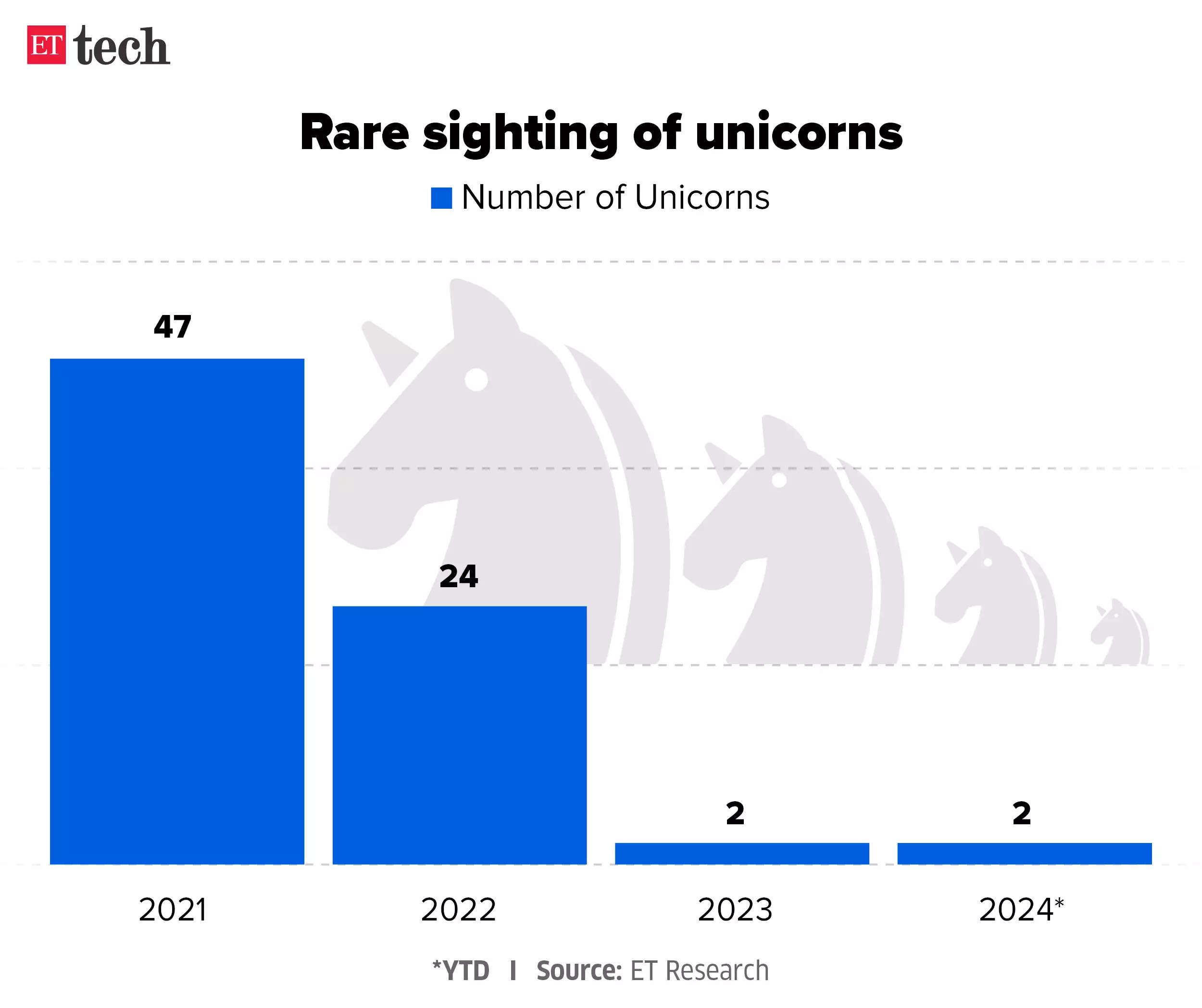

Unicorn sightings become rare as VCs shun that leap of faith: New unicorn sightings among early-to-mid-stage startups have become rare as the ‘leap of faith capital’ is missing even as there is a flurry of activity in late-stage companies, several venture investors and startup founders told ET.

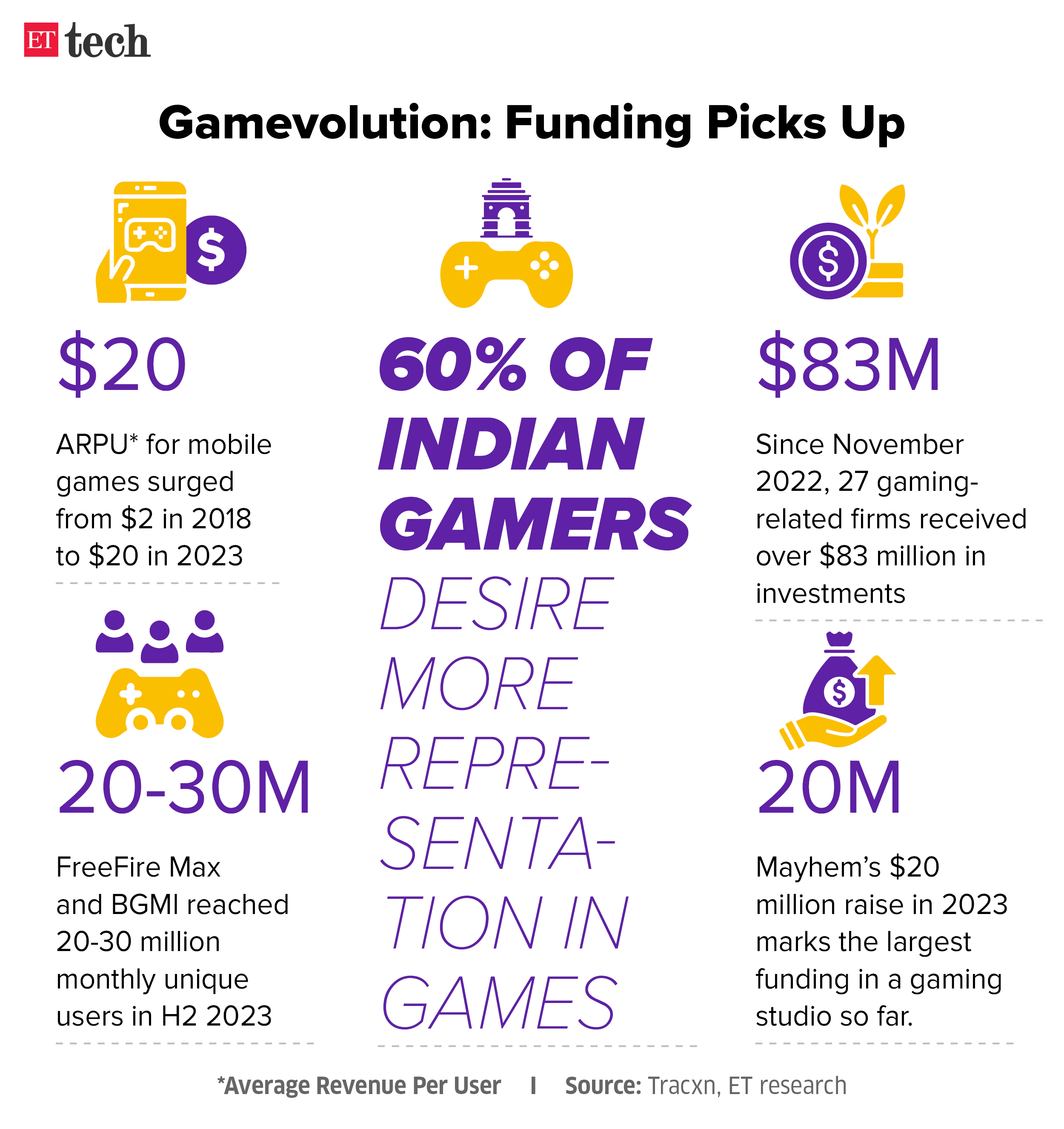

VCs chasing Indian studios working on complex games: Indian studios working on complex games that require heavy investments — so far the sole domain of international publishers like Krafton and Garena — are seeing increased interest from investors, helped in part by fast-maturing consumer and talent cohorts.

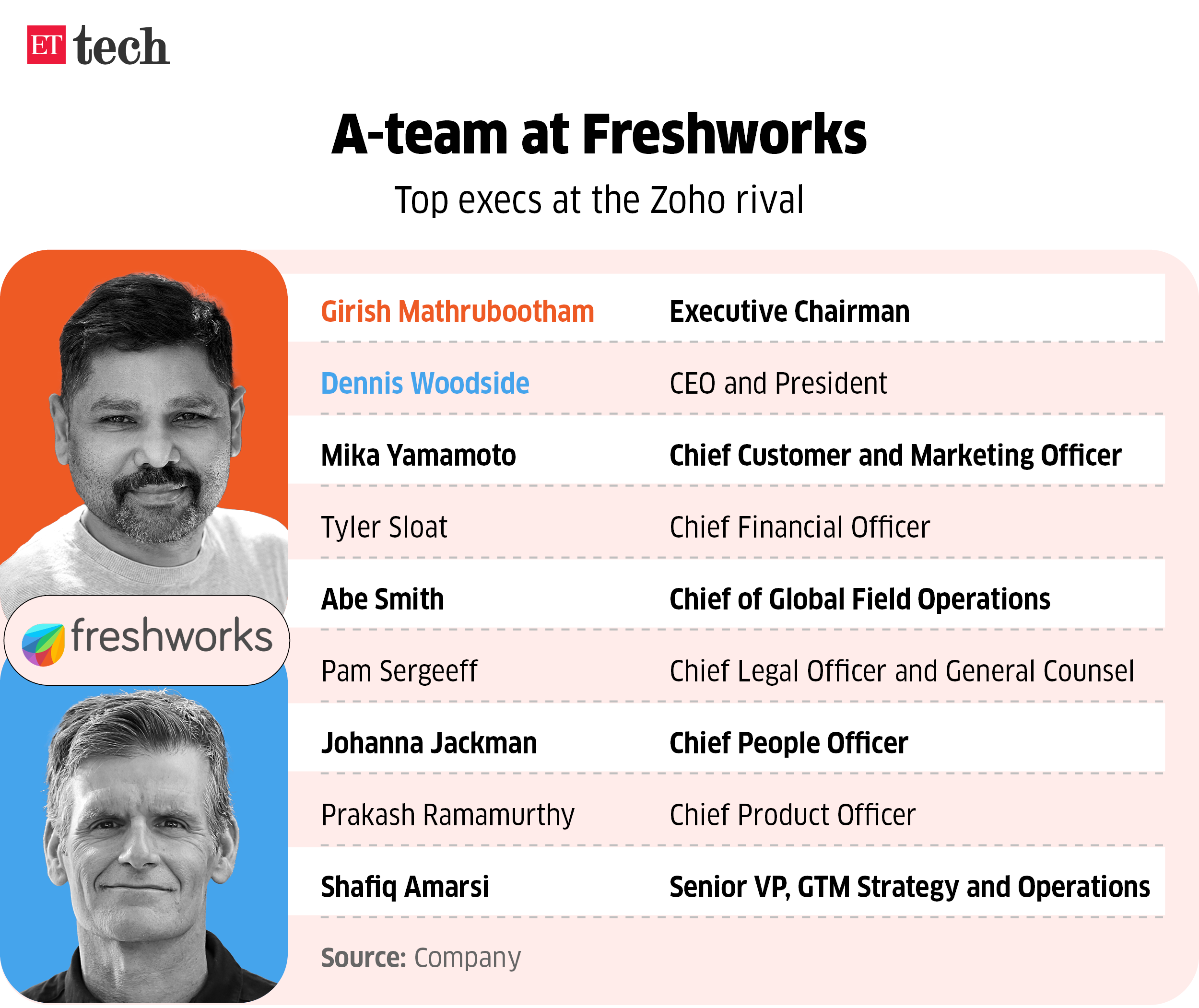

Freshworks stock value drop not due to top deck rejig: Girish Mathrubootham | Freshworks founder Girish Mathrubootham attributed a recent slide in the Nasdaq-listed company’s stock price to market anxiety regarding the impact of the artificial intelligence (AI) wave, dismissing the leadership transition or acquisition announcements that the company made last week as the possible reasons.

IT in focus

Srinivas Pallia, CEO, Wipro

A month on, Wipro CEO Srinivas Pallia has townhalls, Q&As on checklist: As Srinivas Pallia completed one month as CEO of fourth largest software services firm Wipro, which has been trailing its peers on growth and profitability, he has been travelling across the globe to meet employees and stakeholders.

Midcap IT firms up M&A game with winds of tech spends revival: India’s IT services sector is witnessing a flurry of merger and acquisition activities, with several small and midsize firms announcing deals in the past four months in segments ranging from consulting and startups to engineering services, data and analytics.

Cognizant, Capgemini hired 1.5 lakh less hands in 2023: The cumulative hiring by IT majors Cognizant and Capgemini globally declined by 151,607 employees in 2023 as compared to 2022, as per their regulatory filings. In 2023, Cognizant’s hiring number fell to just over 60,000, while Capgemini hired about 61,182. In other words, the numbers fell by 72,000 at Cognizant and 79,607 for Capgemini from the prior year.