Also in the letter:

■ PayU’s Wibmo building a full stack

■ Tata Electronics working on iPhone casing

■ TechM, LTTS earnings

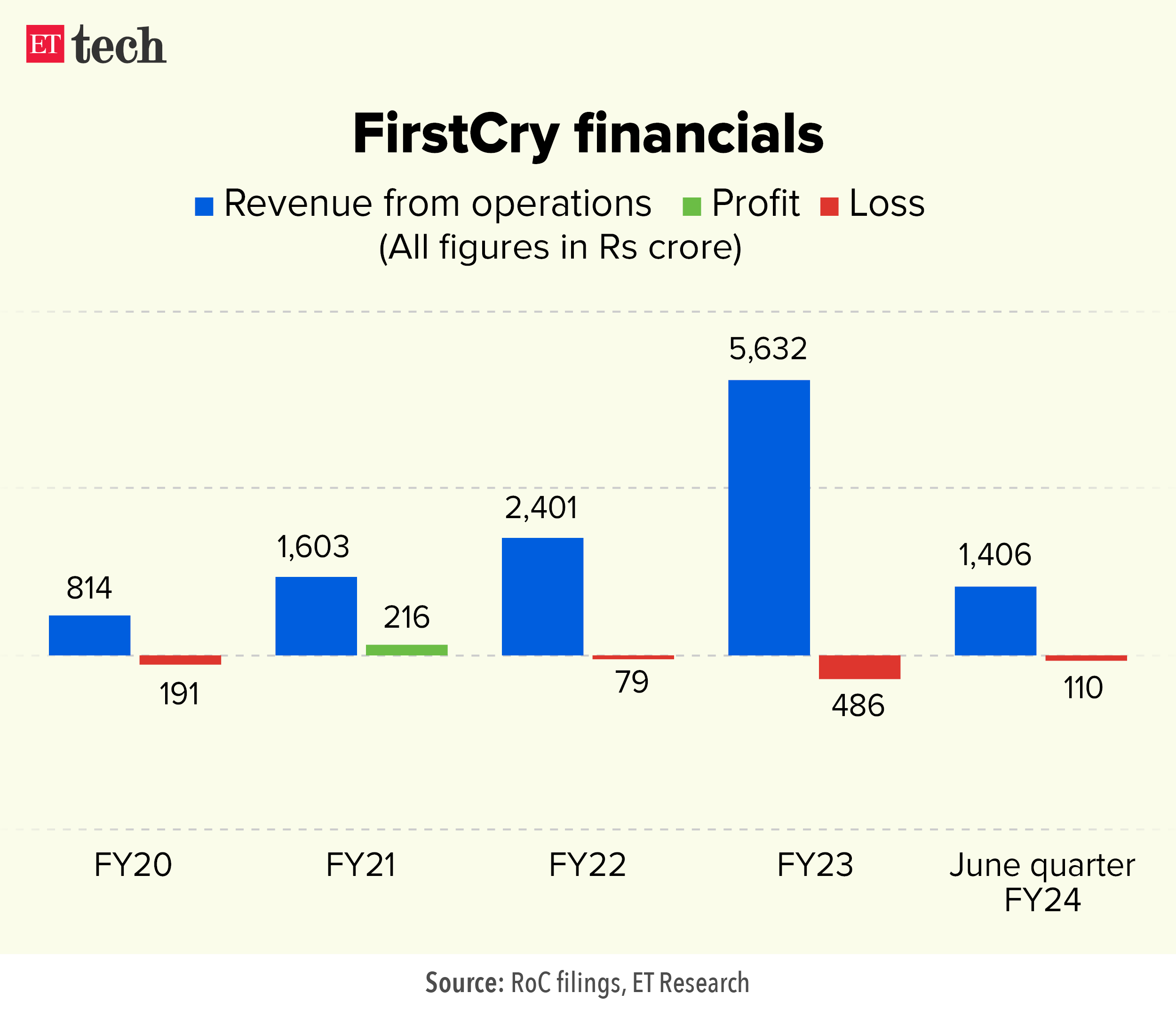

FirstCry to refile IPO application following Sebi directive

Supam Maheshwari, CEO, FirstCry

Facing queries from the stock market regulator, FirstCry, an omnichannel retailer for baby and mother care products, is expected to resubmit its draft IPO papers.

Driving the news: The Securities and Exchange Board of India (Sebi) has flagged lack of adequate disclosures in key performance indicators (KPIs) in the company’s draft papers. Post which the company plans to refile its IPO documents with the latest financials as of March 2024, sources told ET.

“They (FirstCry) had submitted a set of KPIs but Sebi wanted more information as it has been cautious about several new-age firm IPOs leading to value erosion for retail investors,” a person aware of the matter said. FirstCry is expected to make the changes in its filings over the coming weeks, people in the know added.

A banker told ET that the stock market regulator has kept a close watch on KPI disclosures over the past three years.

Background: The Pune-based firm filed its draft red herring prospectus with Sebi in December last year, seeking to raise $218 million in primary funding through an issue of new shares and divesting 54 million shares from existing investors. FirstCry’s IPO is expected to be $500 million in size, depending on the valuation it sets for itself during the public offering.

Swiggy secures shareholder nod for IPO | ET reported on Thursday that Bengaluru-based Swiggy’s shareholders greenlit its IPO worth $1.25 billion.

The company plans to raise Rs 3,750 crore ($450 million) in fresh capital, in addition to an offer-for-sale (OFS) component of up to Rs 6,664 crore ($800 million), according to filings made with the Registrar of Companies. Swiggy is looking to also pick up about Rs 750 crore from anchor investors in a pre-IPO round.

Also read | Prosus may have promoter tag in Swiggy’s $1 billion IPO

Mohit Gupta, Mukesh Bansal’s Lyskraft raises $26 million

Premium fashion and lifestyle platform Lyskraft, founded by former Zomato executive Mohit Gupta and Myntra founder Mukesh Bansal last year, has raised $26 million in one of the biggest seed funding rounds for a local startup in recent years.

Deal details: The fundraise was led by Peak XV Partners, while other investors such as Prosus, Belgian investment fund Sofina, and partners of DST Global have also pumped in capital. A large early-stage round for Lyskraft indicates investor appetite for backing ventures founder by senior executives and repeat entrepreneurs.

What’s the plan? Lyskraft will build an omnichannel play as a marketplace for premium brands, starting with women’s fashion and subsequently expanding into other lifestyle categories. Gupta will lead the company as its CEO while Bansal won’t have an operational role. He will be a strategic advisor and a key shareholder in the business.

The company will take on omnichannel players like Nykaa Fashion as well as online-only companies like Myntra and Reliance Retail’s Ajio. It has onboarded 15 premium women’s apparel brands, and will not opt for in-house manufacturing.

Premium push: “The premium fashion category in India needs to be treated differently which we believe over the next 5-10 years is going to be large enough to be treated as a vertical. Specifically, within this, women’s fashion is a particularly hard category, and we think that the solution to that is not only online or offline but omnichannel, and that’s what we have set out to build,” Gupta said.

PayU’s Wibmo building full-stack payment gateway solutions

Suresh Rajagopalan, CEO, Wibmo

Naspers-owned PayU went on an acquisition blitz between 2019 and 2020, growing inorganically into credit (PaySense), payments authentication (Wibmo), payment gateway (Red Dot Payment). Of all these investments, it’s Wibmo that is turning out to be a trump card for the merchant payments major.

Building a full stack: Wibmo, which was mainly an authentication platform for online card transactions, is now becoming a full stack payment gateway. From fraud detection capabilities to prepaid issuance, Wibmo is working with large banks in India and abroad to power their digital services. PayU, which till recently was under an embargo on adding new customers, leveraged Wibmo’s capabilities to build deeper relationships with banks.

Going global: Wibmo, founded way back in 1999, has relied mostly on Indian banks for business. According to CEO Suresh Rajagopalan, even three four years back Wibmo would get around 96% of its revenues from India. However, that is changing now. Currently Wibmo gets 36% revenues from outside the country, and the management aims to take this to 40% by the next fiscal.

Catch up quick: In November PayU’s global head of strategy, mergers and acquisitions and investments, Vijay Agicha, had told us that the payments major was looking to build capabilities in B2B payments and supply chain financing.

Other Top Stories By Our Reporters

Tata Electronics building hi-tech machines to make iPhone casing: After becoming a significant player assembling enclosures for Apple iPhones in the country, Tata Electronics is now working to internally develop “very sophisticated” and complex high-precision machines used to produce the casing of these iPhone, sources told ET.

Tech Mahindra Q4 net profit down 41% to Rs 661 crore; revenue tanks 6.2%: Tech Mahindra, country’s fifth largest IT services firm, reported a decline in net profit of 40.9% year-on-year to Rs 661 crore primarily driven by slowdown in its telecom, communications, media and entertainment business, which is its largest vertical with 36.5% market share.

Cyient’s profit grew 22% to Rs 196 crore in Q4: Engineering service provider, Cyient’s net profit grew to Rs 196 crore in the final quarter of FY24, up 22% sequentially. On a year-on-year basis, the profit for the Hyderabad-based firm grew by 20%.

LTTS’ net profit grew 0.2% to Rs 341 crore: L&T Technology Services (LTTS) reported a net profit of Rs 341 crore in the March quarter of FY24, up 1.4% quarter on quarter. The profit for the company grew by just 0.2% on-year.

Global Picks We Are Reading

■ Ads for explicit ‘AI girlfriends’ are swarming Facebook and Instagram (Wired)

■ How TikTok’s Chinese owner tightened its grip on the app (FT)

■ What it takes to raise a $300 million VC fund for Africa (Rest of World)